As business landscapes evolve, exploring new markets and expanding overseas have become a key priority for many Singapore companies. This is particularly evident among Small and Medium-sized Enterprises (SMEs), which are increasingly recognising the immense potential that lies beyond their domestic borders. The DBS annual SME Pulse Check survey conducted at the end of 2022 revealed that over 60% of SMEs in Singapore have indicated overseas expansion as a key business priority[1]. This is contributed by the reopening of borders along with support from government schemes such as the enhanced Enterprise Financing Scheme[2] announced in Budget 2023, which enables local companies to gain access to financing across all stages of growth.

Among the array of enticing markets, Japan has emerged as a particularly alluring destination for Singaporean businesses. Apart from having a large consumer market backed by sizable economy, bilateral agreements were signed between both nations in May 2022 to boost the flow of entrepreneurs and enterprises by promoting greater access to start-up and innovation ecosystems[3]. Initiatives such as business matching sessions to connect Singapore and Japanese firms with accelerators, business partners and investors, are put in place to empower businesses to build market knowledge and tap into new opportunities, deepening their networks in the process.

Drawn by the influx of tourists into Japan in a post-pandemic era, five-star resort hotel operators from Singapore, Capella Hotels & Resorts and Banyan Tree Holdings, have announced plans to enter the Japanese market. Capella Hotels & Resorts intends to open its first Japanese hotel in Kyoto as early as the summer of 2025[4], located on Yamatooji-dori in the historic Miyagawa-chō district[5]. The office of renowned architect Kengo Kuma, which designed the Japan National Stadium for the 2020 Tokyo Olympics, is supervising the construction. On the other hand, Banyan Tree Holdings plans to open flagship hotels in Kyoto and Hakone from now through 2026. These hotels aim to provide signature standards of service that will serve as a benchmark for all future Banyan Tree locations in Japan[6]. The presence of Singapore hotel groups in Japan contributes to enhancing tourism infrastructure while attracting affluent visitors to experience premium accommodations.

Shifting the focus to a more mass-market brand, Singapore design studio Beyond the Vines launched its first international pop-up store in Tokyo in March 2023 as it seeks to grow its international presence[7]. The brand, known for its minimalist and contemporary designs, has gained popularity in Singapore and other Southeast Asian markets. Its entry into Japan reflects its recognition of the country’s vibrant fashion scene, and the opening in Tokyo allows the brand to tap into the city’s fashion-conscious consumer base. While the initial pop-up store only lasted for a week, Beyond the Vines has since launched another pop-up at Miyashita Park North in Shibuya, which will remain at the location for a month until the end of July 2023. The expansion demonstrates Singapore’s fashion industry’s potential to resonate with the Japanese market.

On the technology front, Singapore-headquartered Fintech company M-DAQ Global has announced the opening of its Japanese office in Fukuoka in September 2022[8]. The company specialises in providing currency conversion and payment solutions, enabling businesses to transact seamlessly across different currencies. It sees opening a subsidiary office in Fukuoka as a natural fit for a myriad of reasons, including its similarity to Singapore in terms of the active collaboration between private and public sectors to develop innovative solutions for business needs and quality of life improvements. M-DAQ has since commenced discussions with the Fukuoka City Government, Kyushu Railway Company and other entities to improve the foreign currency user experience when making retail and travel transactions. This expansion highlights Singapore’s ability to deliver advanced financial services on an international scale.

In addition to Singapore companies that entered the Japan market recently, others are exploring pathways through trade exhibitions. The Franchising and Licensing Association (FLA) has led a delegation made up of popular Singapore brands including Crystal Jade, Five Star Chicken Rice, Playmade and iJooz, in forming the Singapore Pavilion exhibiting at the 40th Japan International Franchise Show in March 2023. Through this event, local companies sought potential business partners to carry their brand, while gaining an initial sense of their product acceptance in Japan.

These activities underscore the increasing interest and capabilities of Singaporean companies in capturing opportunities in the Japanese market. With that being said, entering the Japanese market presents a set of unique challenges for Singaporean companies, ranging from language and communication barriers to cultural nuances and intense competition. Overcoming these obstacles is crucial for successful market entry.

Enterprise Singapore assists Singaporean companies in their internationalisation efforts by providing various support initiatives, including grants and market access programs, to facilitate market entry. For instance, the Market Readiness Assistance (MRA) Grant offers financial support to Singaporean companies to defray a significant portion of eligible costs associated with market entry activities, helping businesses assess market potential, establish networks and promote their products or services[9].

Hailing from Japan, JETRO (Japan External Trade Organisation) operates in Singapore with the mission of promoting trade and investment between Japan and Singapore. ‘Invest Japan’ serves as a platform to attract and assist Singaporean companies interested in establishing a presence in Japan. Through this initiative, JETRO offers support services including consultation services on company incorporation, networking opportunities and temporary business office facilities in Japan among others to help Singapore companies make a more informed decision prior to market entry[10].

IGPI Singapore offers a range of services to support Singapore businesses in their overseas expansion. Services can be broadly divided into:

● Management consulting, where we help companies identify growth opportunities, develop strategies to establish a presence in the target market. In the process, we often employ business matching techniques to find suitable local partners which could be crucial to successful market entry

● M&A advisory, where we guide companies through the end-to-end deal process, ensuring successful transactions

Our past and current engagements include:

● Supporting a local F&B chain in its market entry into Japan, including performing a market study, identifying and selecting the most suitable strategic partner

● Supporting a local wholesaler and retailer in its market entry into Japan through business matching, by shortlisting promising partners and facilitating discussions towards the formation of the partnership

● Organising missions trips to Tokyo with various industry associations, where we led delegations made up of senior executives from Singapore companies to gain insight into doing business in Japan

IGPI Singapore can support your company in its market entry into Japan and maximise its chances of success – Get in touch with us!

[1] The Straits Times: Exploring new markets, expanding overseas key priorities for most Singapore SMEs: Survey (21 Mar 2023): https://www.straitstimes.com/business/exploring-new-markets-and-expanding-overseas-are-top-priorities-for-most-s-pore-smes-survey

[2] For more details, please visit: https://www.enterprisesg.gov.sg/financial-support/enterprise-financing-scheme

[3] CNA: Singapore, Japan ink agreements on promoting start-ups, digital transformation for governments (26 May 2023): https://www.channelnewsasia.com/singapore/singapore-japan-ink-agreements-promoting-start-ups-digital-transformation-governments-2709716

[4] Nikkei Asia: Thai, Singapore hotel groups target Japan’s tourism boom (26 Jun 2023): https://asia.nikkei.com/Business/Travel-Leisure/Thai-Singapore-hotel-groups-target-Japan-s-tourism-boom

[5] Artist’s impression of the upcoming Capella Kyoto: https://capellahotels.com/en/capella-kyoto

[6] Banyan Tree Group Press Release (Jun 2022): https://www.banyantree.com/assets/2022-06/220624-banyan-tree-group-debuts-japan.pdf

[7] Inside Retail: Singapore’s Beyond The Vines to open first store in Japan (15 Mar 2023): https://insideretail.asia/2023/03/15/singapores-beyond-the-vines-opens-first-store-in-japan/

[8] Technode Global: Singapore’s M-DAQ Global Opens Japan Office as part of international expansion (13 Sep 2022): https://technode.global/2022/09/13/singapores-m-daq-global-opens-japan-office-as-part-of-international-expansion/

[9] For more details, please visit: https://www.enterprisesg.gov.sg/financial-support/market-readiness-assistance-grant

[10] For more details, please visit: https://www.jetro.go.jp/singapore/investinjapan.html

Mr. Ryota Yamazaki is the Director of IGPI Singapore. Before joining IGPI, Ryota worked in Deloitte Consulting in Singapore, where he was a leader in the areas of Consumer Business and Supply Chain & Logistics in Southeast Asia. His areas of expertise are Strategy & Operations such as market entry, Route-to-Market (RTM) strategy, business due diligence, and PMI. He started his career with A.P. Moller-Maersk Group as a management trainee and also worked for Kurt Salmon, where he had vast project experiences especially in Supply Chain & Logistics for the retail and consumer goods clients. Ryota graduated from the Faculty of Economics at Keio University.

Mr. Zhi Hao Thean is an Associate at IGPI Singapore. Zhi Hao started his career with IGPI. He graduated from Singapore Management University with a Bachelor of Business Management, majoring in Finance. During his time at IGPI, he is involved in multiple engagements pertaining to market entry, strategy development and benchmarking studies across diverse industries.

Industrial Growth Platform Inc. (IGPI) is one of Japan’s premium management consulting and investment firms headquartered in Tokyo with offices in Singapore, Hanoi, Shanghai and Melbourne. IGPI was established in 2007 by former members of Industrial Revitalization Corporation of Japan (IRCJ), a USD 100 billion sovereign wealth fund focusing on turn-around projects in Japan. IGPI has 14 institutional investors, including Nomura Holdings, SMBC, KDDI, Recruit and Sumitomo Corporation to name a few. IGPI has vast experience of supporting Fortune 500s, Govt. agencies, universities, SMEs and funded startups across Asia and beyond for their strategic business needs such as market entry and growth strategies, various aspects of M&A, innovation advisory, new business creation etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with it making our own venture investments (30+ till date) adds to our uniqueness. One of our recent investment endeavours has been a VC fund in Europe (EUR 100mn fund) along with Honda, Panasonic, JBIC etc. (a couple of our investees are now unicorns). IGPI group has ~6,000 employees on a consolidated basis.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.

In this article, we highlight why it is imperative for CPG companies of all sizes across the value chain, now more than ever, to develop or refine their rationalisation framework in their product management toolbox, share key success factors in crafting a rationalisation strategy and shed light on common pitfalls.

In 2021, facing rising input cost inflation and squeezed margins, Nestlé S.A. kicked-off Project TASTY as part of a wider value creation strategy, focusing on achieving cost savings, margin improvements and long-term growth via SKU rationalisation and recipe and packaging optimisation.

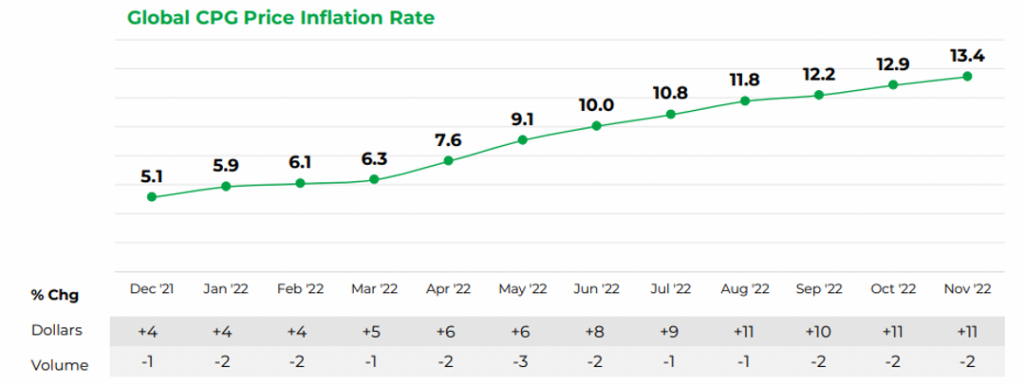

Table 1: NIQ 2023 Consumer Outlook Report – Global CPG Price Inflation Rate

One year on, CPG companies across the value chain faced persistent inflation, driving prices higher and negatively impacting sales volumes across categories. The pandemic also accelerated digital transformation across the entire value chain, with CPG companies of all sizes finding themselves at varying stages of implementing and leveraging newfound digital infrastructure, data pools and analytical capabilities. Changing consumer preferences stemming from rising prices and the pandemic include a rising preference for online shopping, variations in purchase frequency and a flight towards value, albeit varying across the different product categories.

Such shifts warrant a reprioritization of multi-dimensional criteria in assessing an SKU’s historical financial and operational performance and strategic importance in the short and long-term. At a time of internal change and external shifts, CPG companies have been presented with a golden opportunity to revisit their product mix management strategy, spanning both SKU innovation and rationalisation.

Performing a one-off innovation or rationalisation exercise will not suffice – corporations should capitalise by fundamentally redesigning their product mix management frameworks, leveraging new consumer touchpoints, access to big data and advanced analytics while revisiting and updating previous methodologies and key performance indicators (KPIs). In lieu of current cost-side pressures, SKU rationalisation remains a priority and a valuable first step in the SKU optimisation cycle.

Category managers and executives have long understood the need to consider the importance of considering multiple performance dimensions in addition to SKU-level financials and embracing product basket synergies, overall mix value contribution and long-term growth potential.

In developing or refining existing frameworks, much emphasis is placed on analytical capabilities, data collection and execution agility. However, CPG companies today should also consider strategic elements that have significant bearing on the value unlocked from a rationalisation exercise, such as the following:

The push for digital transformation entails new infrastructure, workflows and data collection and analysis capabilities. In the midst of change, companies that capitalise on this opportunity to amalgamate existing SKU rationalisation workflows and data needs with new systems will be able to minimise resources spent on data interpretation and developing actionable insights.

In migrating to new systems, optimization from the collection of data through to the visualisation and framing of key indicators is imperative and companies must actively drive the development of integrated workflows from the get-go. Executives and managers should also re-evaluate existing digital infrastructure and contrast this against rationalisation needs and the price and value of current market offerings.

In the pursuit of data-driven insights on SKU performance, companies must also recognise the value of consolidating, interpreting and transforming qualitative inputs from within the organisation (and in some instances, select third-parties involved in distribution, retail or day-to-day operations) into actionable items. More often than not, following rigorous quantitative analysis, qualitative assessments are performed at the executive level or within the steering committee as a final ‘check’ just before implementation to ensure alignment with leadership’s understanding. In doing so, a wealth of insights from the ground remain untapped and deep understanding of select categories or products are not fully leveraged.

To capitalise, companies must embark on a path of systemizing qualitative inputs, designing existing SKU rationalisation frameworks to periodically collect, consolidate and transform feedback from the ground into actionable items.

Forming the basis of a periodic rationalisation exercise is a set of clearly quantitative targets spanning different performance dimensions, such as a minimum improvement in gross margins or process cycle efficiency. Leveraging stronger analytical capabilities and big data, companies can supplement such targets with sensitivity analyses comprising multiple iterations and combinations to obtain a clearer picture of:

(1) The array of possible rationalisation solutions to achieve current targets

(2) The extent of marginal improvements by extending the number of SKUs reduced in different scenarios

In doing so, companies shift from a target-focused mentality to one of value-maximisation, driving larger value gains in the long run. The steering committee and key decision makers should also note the interests of other stakeholders and evaluate the pros and cons of adopting a rationalisation strategy based on the company’s ultimate priorities.

IGPI Singapore worked with a beverage distributor undergoing a major system migration to analyse their existing SKU portfolio and recommend candidates for rationalisation, which would improve:

● Financial metrics by driving gross margins

● Operational metrics by improving warehouse inventory turnover

● Strategic metrics by aligning the SKU mix with the firm’s strategic direction

We designed a framework detailing each step of our approach to the rationalisation, beginning with segmenting SKUs into analysis groups based on key criteria. We proceeded to develop and refine the KPI that determined each SKU’s performance. Next, we performed multi-dimensional analysis supplemented with sensitivity analyses for each KPI to identify potential candidate SKUs, while managing data coherence across legacy and new systems. Finally, we incorporated qualitative insights drawn from departments within the company and industrial best practices to develop our final rationalisation recommendations.

Recognizing the importance of implementing a sustainable solution for our client rather than a one-off exercise, we developed a tailor-made rationalisation tool custom-fitted for the new system to allow managers to replicate our work steps, perform the rationalisation exercise and quantify the impact on KPIs independently going forward.

The rationalisation led to a significant reduction in the number of SKUs, projected growth in gross margins and improved operational workflows.

High-level company-wide strategic direction and goals underpin a rationalisation exercise, forming the basis of rationalisation targets and facilitating compromise across KPIs in pursuit of long-term value. Companies must beware of the formation of silos and internal misalignment on wider company goals between departments, which lead to tunnel vision, push-back and low quality implementation. A common example is the conflict of interest between sales and cost centres, leading to either topline targets or cost savings achieved at the detriment of the other. This can be addressed through a clear prioritisation process, facilitated conversations across key functions and dedicated resources to achieving compromise. Taking the middle ground will not be the indicator of successful alignment – a compromise in lieu of company objectives will.

Evaluating the financial performance of an SKU leverages heavily on allocating key components in the cost-to-serve equation to individual SKUs to obtain gross and contribution margins. Analysis quality is only as good as the quality of its input data – underlying assumptions such as allocation base have significant implications on the results of the rationalisation and if suboptimal, may result in the trimming of well-performing SKUs mistakenly classified as poor performers along select KPIs. Companies can mitigate this through comprehensive analysis of cost drivers and testing existing assumptions through iterations of rationalisation execution and review.

The gap between actionable insights and executing on said insights is a major factor in determining the long-term benefits reaped from a rationalisation exercise, especially in the context of operations and workflows. Compared to insight derivation, this step involves more stakeholders and key process owners, requires more nuance in implementation and is far less straightforward. Companies must devote sufficient resources to support the transition following a rationalisation throughout the organisation, be it in terms of product portfolio, brand equity, sales strategy or people-related factors such as upskilling, managing workflow changes and resource allocation, etc. More often than not, such responsibilities fall to the decision makers in the rationalisation exercise – companies should recognise shared responsibilities and understand that a new pair of hands, more experienced or suited in implementing solutions, may be required to take over from the initial decision makers. A possible solution is the concept of segmenting and allocating scopes to different process owners, to make good executive decisions on what to rationalise and address the issue of how and when.

SKU rationalisation has always been a continuous process, enabled now more than ever with the advent of analytical capabilities and round-the-clock data collection. A key component of the value in rationalisation lies in the future insights derived from acting on current actionable items and with each performance, product portfolios and existing frameworks are refined to maximise value. Opportunistic rationalisation exercises conducted in times of distress fail to leverage on this, resulting in superficial performance analysis and one-off improvements with minimal impact. Successful companies integrate rationalisation into workflows and continually improve analysis processes, implementation frameworks and strategies, developing self-sustaining engines over time.

IGPI has deep experience in strategising, developing, analysing and implementing sustainable product optimisation solutions for companies across all parts of the value chain based on a proprietary approach, leveraging our expertise in multiple sectors in the wider CPG industry. To find out more about how we can support your value creation endeavours, get in touch with us here.

Mr. Hoong Tian Jin is an Associate in IGPI Singapore. Before joining IGPI, Tian Jin started his career at Ernst and Young Singapore in the Assurance service line, where he led digital audits and reviewed operational controls of healthcare, pharmaceutical and manufacturing companies. During his time in university, he also worked at an e-commerce start-up performing business development, online marketing and search-engine optimisation. He graduated from the National University of Singapore with a Bachelor of Business Administration (Accountancy). Tian Jin is proficient in English and Mandarin. He is passionate about corporate and social responsibility and volunteers regularly with numerous non-profit organisations to give back to society. In his leisure time, he enjoys football, music and chess.

Industrial Growth Platform Inc. (IGPI) is one of Japan’s premium management consulting and investment firms headquartered in Tokyo with offices in Singapore, Hanoi, Shanghai and Melbourne. IGPI was established in 2007 by former members of Industrial Revitalization Corporation of Japan (IRCJ), a USD 100 billion sovereign wealth fund focusing on turn-around projects in Japan. IGPI has 14 institutional investors, including Nomura Holdings, SMBC, KDDI, Recruit and Sumitomo Corporation to name a few. IGPI has vast experience of supporting Fortune 500s, Govt. agencies, universities, SMEs and funded startups across Asia and beyond for their strategic business needs such as market entry and growth strategies, various aspects of M&A, innovation advisory, new business creation etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with it making our own venture investments (30+ till date) adds to our uniqueness. One of our recent investment endeavours has been a VC fund in Europe (EUR 100mn fund) along with Honda, Panasonic, JBIC etc. (a couple of our investees are now unicorns). IGPI group has ~6,000 employees on a consolidated basis.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.

The motivation of this article is to capture select examples of the Australia-Japan innovation activity across diverse stakeholders and to draw attention towards keeping a closer eye on Australia’s innovation ecosystem where many opportunities exist and cut across business, technical and financial collaboration with startups, universities etc.

Japan is an advanced nation that has historically enjoyed the reputation of being a tech front-runner. It has contributed many innovative companies to the world. This has been largely driven by the commitment to quality and a strong work ethic that propelled Japan to economic success in the post-world war II era. Japan went on to become the 2nd largest economy in the world after the United States. This was followed by the ‘lost decade’ when Japan’s economic bubble burst. Since then Japanese companies have been constantly redefining themselves in an ever-evolving world.

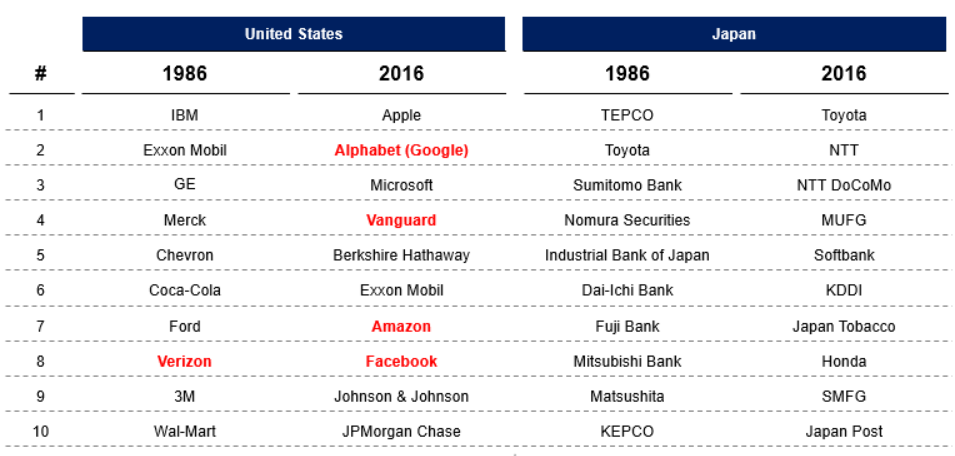

At the same time, if we zoom out to the global stage across the past few decades – where the world was becoming smaller, closer and more global with every passing year, new companies (“startups”) were grabbing the limelight and opening their wings. These companies include the likes of Apple, Google, Amazon etc. which don’t require any introduction. Taking a closer look at the top 10 rankings by largest market capitalization between Japan and USA[1], one would immediately spot that some of the “new” companies that can be seen as torch-bearers of innovation actually became bigger than the conventionally large players such as auto manufacturers, financial institutions etc.

Table 1: Top 10 rankings of the largest market cap companies in 1986 & 2016

(*Companies in red font are 30 years old or less)

The above table reaffirms a very clear message about the importance of innovation. Most corporations are built around a unique set of products or services. That’s why at a certain point, they reach a point of saturation, where their product line has been upgraded/extended to the maximum. The profit margins stop growing so dynamically. When they reach that moment (or are about to), they need to innovate to keep growing[2]. Harvard Business Review reports that since 2000, 52% of enterprises in the Fortune 500 “have either gone bankrupt, been acquired, or ceased to exist” due to digital transformation[3].

In order to innovate, from a Corporate lens, the innovation can be simplistically be classified into two types:

(1) Closed – E.g. Internal R&D, In-house innovation labs, Internal accelerators etc.

(2) Open – E.g. Corporate VCs (CVCs), External accelerators, Innovation teams etc.

In recent years, more and more Japanese companies have been actively promoting the idea of open innovation. With many Japanese companies operating beyond borders in search of new solutions, there are increasing opportunities for overseas companies as well[4]. The typical destinations for open innovation outside of Japan have been the USA, Europe, Israel, Singapore etc. This can be corroborated by a quick search of the destinations where Japanese CVCs mostly set their mandates. For e.g. Sony Innovation fund which has US$250m AUM has offices in US, EU, Israel, Japan and India[5].

With this backdrop, the focus of this article is to draw attention to Australia’s startup ecosystem which sometimes gets overshadowed or under-appreciated amidst the global innovation ecosystems that many Japanese corporations turn towards for their open innovation initiatives.

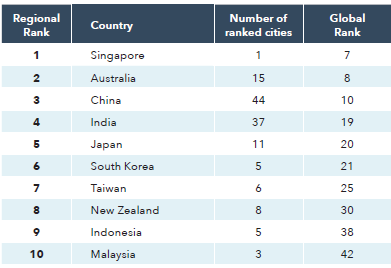

While to some, Australia is more popularly known for sandy beaches and ocean views, Australia’s startup ecosystem (with ~6,500 startups[6]) is promising with innovation across various sectors that is rapidly growing. A study by Startup Blink ranks Australia at 8th place globally and 2nd place within the APAC region for its startup ecosystem[7].

Table 2: Startup Blink Global Ranking Index 2022 – Asia Pacific

The above holistic scorings are based on the sub-scores measuring quantity score (including the number of startups, co-working spaces, accelerators, startup-related meetups, etc.), quality score (including traction of entities in all ecosystems, presence of strategic branches and R&D centers, presence of unicorns, exits, and pantheon companies, global startup events, number of startups backed by accelerators, etc.) and business environment score (including diversity index, internet freedom, R&D investment, number of patents per capita, top universities per location, etc.). Such rankings can help provide a good flavor of the relative prominence of Australia’s startup ecosystem in the region.

When it comes to the sheer scale of startups, Australia has been performing well for its population size with 21 unicorns as of Oct’22 – many of which have been opening their wings on the global stage –

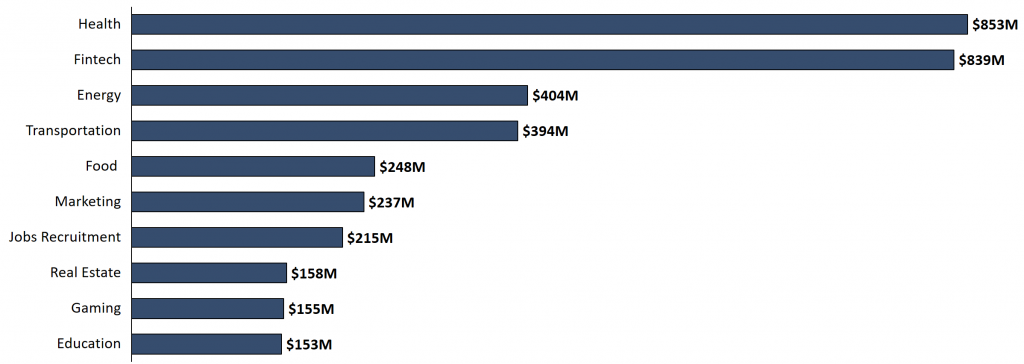

In terms of sector attractiveness from an investor’s perspective, Health, Fintech, and Energy are the top 3 industries that received funding in Australia in 2022. Health startups raised the most money in 2022 ($853 million), followed by Fintech ($839 million), and Energy ($404 million), according to Dealsroom.co. (see Figure 1)

Figure 1: Australian startups’ fund raised by sector in 2022[8]

The Australian innovation startup ecosystem has been growing and is further catalyzing. Australia venture capital Airtree, Blackbird and Square Peg raised a staggering amount of ~$2.5 billion in new funds in 2022 showing confidence to grow the Australian startup ecosystem further.

Japanese companies have been expanding overseas for decades – including Australia. Therefore, Australia is not ‘new’ for Japan but historically it is also true that Australia was largely being seen through the lens of conventional businesses (e.g. “digging the earth” etc.). This was in stark contrast to countries such as the USA that built a strong reputation for technology (e.g. Silicon Valley) during the same period and attracted Japanese corporates to explore innovation opportunities too. For example, many leading Japanese CVCs have strong activities in the USA while in an Australian context, the examples are far and few. This is because, for many Japanese corporations, Australia’s name and perception of innovation don’t come in the same breath as Silicon Valley, Singapore, Israel, etc.

Unfortunately, these perceptions can’t evolve overnight but there are reasons why Japan should look more closely at Australia with a dual objective – (i) Scouting innovation to solve Japan’s challenges and (ii) New business creation opportunities for Japanese Corporates in Japan and beyond.

Some of the various sectors in Australia that can be considered and are not limited to

From a Japanese lens, apart from the facts stated above, some of the reasons why Japan should consider Australia more closely are:

The good news is that in recent years, Japanese Corporates have been getting relatively more active in the Australia-Japan innovation corridors. But don’t take our word for it – let us look at some examples that encompass a variety of ecosystem players, including startups, universities, and financial institutions / venture funds. These various collaborations can be in the form of business, technical or financial collaboration.

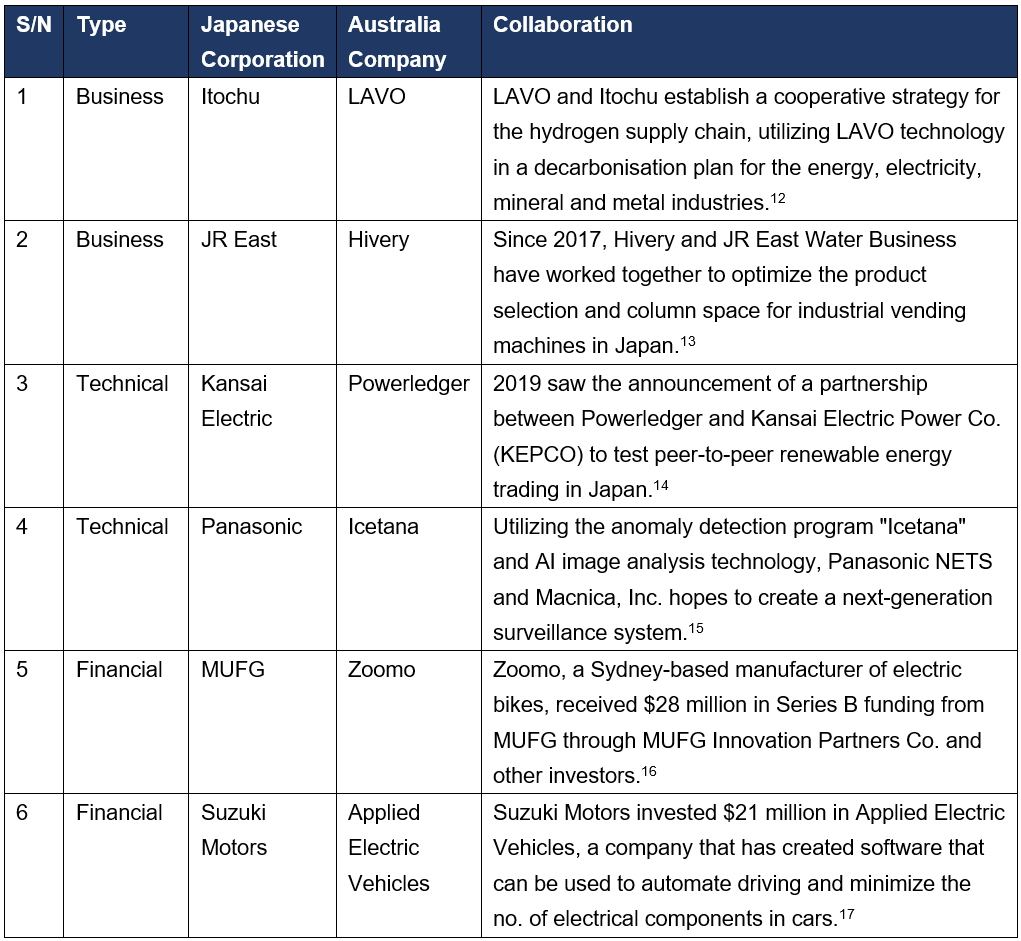

Collaborations between Japanese enterprises and Australian startups are growing as Japanese organizations are becoming more receptive to “open innovation” with Australian companies. The spectrum of partnerships in these sectors includes energy, smart cities, mobility, etc. and examples include:

Table 3: Examples of collaborations between Japanese corporation and Australia startups

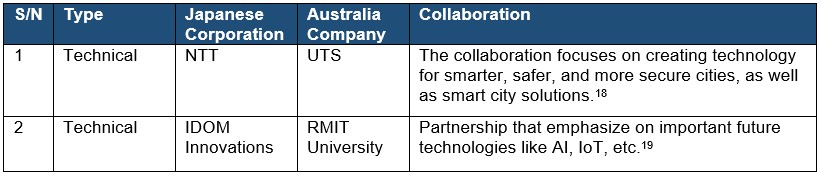

Japan has a great appreciation for the educational and scientific institutes of Australia and new relationships are increasingly being established between Australian universities and Japanese companies. Some examples of collaborations include:

Table 4: Examples of collaboration between Japanese corporation and Australia Universities

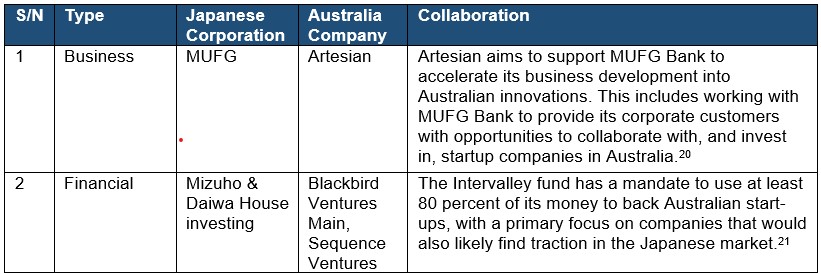

Japanese investors, both new and established, are increasingly trying to focus on the innovation prowess of Australia. Some examples include:

Table 5: Examples of collaborations between Japanese and Australia Financial Institutions / VCs

Collaboration between Australia and Japan can be seen in many different angles and different stakeholders are playing their part to increase awareness and provide support to foster cross-border innovation between both countries. For example, JETRO launched J-Bridge (Australia) in 2021, a platform for exploring various prospective partnerships between Japanese corporations and Australian startups that strives to create a bridge of innovation between the countries.

To conclude, Australia is an exciting region to consider and has been overshadowed by other prominent startup ecosystems in the US and Europe, etc. However, the growing number of collaboration examples in Australia-Japan’s innovation corridors can potentially turn more Japanese Corporates’ attention to this innovation hub down under too – and if you have preconceived notions, you may well be in for a (pleasant) surprise!

IGPI is well networked with most Japanese mega corporations as well as Australian startups – be it Japan (HQ), ASEAN (RHQ in many cases) and Oceania offices and support them for a number of initiatives. If you are an Australian startup, we can assist you find the right potential partner for your market expansion plans beyond Australia. IGPI provides highly customized APAC business advisory to its diverse range of clients including but not limited to:

[1] S&P Capital IQ, Diamond Company Ranking

[2] Iterators, Corporate Innovation Guide: Problems, Solutions & Real Life Use Cases (2023)

[3] Harvard Business Review, Digital Transformation Is Racing Ahead and No Industry Is Immune (2017)

[4] JETRO, The current situation of open innovation in Japan: The points that overseas companies should bear in mind (2021)

[5] Sony Innovation Fund, About Sony Innovation Fund (n.d.)

[6] TechCouncil of Australia, Turning Australia into a regional tech hub, https://techcouncil.com.au/newsroom/turning-australia-into-a-regional-tech-hub/

[7] StartupBlink – Global Startup Ecosystem Index 2022 (2022)

[8] Dealroom.co, Update on Australia’s startup ecosystem in 2022 (2022)

[9] Innovation Intelligence – The future of Australia’s smart cities (2022)

[10] All Things Distributed, Is Australia the new epicenter for healthtech startups? (2023)

[11] AgFunder News, Innovation hub AgriFutures growAG. plans to make Australia the agtech capital of the Southern Hemisphere (2022)

[12] FuelCellWorks, LAVO and ITOCHU Corporation Collaboration to help industries achieve SDG (2022)

[13] Hivery, Australian AI startup, HIVERY, partners with JR East Water Business to optimize vending machines in Japan (2020)

[14] Powerledger, P2P renewable energy trading in Japan (2018)

[15] Icetena, Construction of next gen surveillance system (2021)

[16] Business News Australia, E-bike innovator Zoomo goes full throttle with extra $28m in Series B (2022)

[17] Startupdaily, Suzuki drives $21 million raise for electric vehicle software startup Applied EV (2022)

[18] NTT, University of Technology Sydney and NTT Group partner to promote smarter, safer and more secure cities (2021)

[19] Herbert Smith Freehills, Japan-Australia Investment Report 2022: Decarbonisation (2022)

[20] Ashurt, Landmark business alliance formed between Artesian and MUFG Bank (2023)

[21] AFR, Japanese institutions turn their eyes towards Aussie tech start-ups (2021)

Mr. Rachit Khosla is the Country Manager of IGPI Australia. Rachit is a seasoned strategy consulting professional with over 14 years’ experience of leading and executing market entry and growth strategy (both organic and inorganic) and open innovation engagements for Fortune 500 businesses and large MNCs across Asia Pacific. He has advised clients in a diverse range of industries including automotive, fin-tech, industrial and manufacturing, med-tech & healthcare, smart cities, construction materials, travel, IT & telecommunications to name a few. Rachit was the former Country Manager and Director for YCP Solidiance (Japanese owned) and Founder and CEO of an online B2B marketplace startup for professional advisory services focused on Emerging Markets.

Mr. Nicholas Quek is an Analyst in IGPI Singapore. Nicholas graduated from Singapore Management University with a Bachelor of Business Management, majoring in Finance. During his time in university, he gained internship experience at OCBC bank where he took on a compliance role responsible for AML. He was also a Teaching Assistant for Financial Markets and Investments, and a Research Assistant for Real Estate Investment Trusts (REITs). In his final year, Nicholas embarked on an experiential learning course where he formulated strategies to increase e-commerce sales for an MNC. He also analyzes and identifies innovative Australian companies in the space of carbon neutral, smart city (incl. energy SaaS), mobility, etc. to help foster collaboration with Japanese corporations in ecosystem-level engagements.

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with presence and coverage across Asian markets. IGPI was established by former members of Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around fund supported by the Japanese government.

IGPI has vast experience of supporting Fortune 500s, Govt. agencies, universities, SMEs and startups across Asia and beyond for their strategic business needs such as market entry and growth strategies, various aspects of M&A, innovation advisory, new business creation etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with it making its own venture investments (30+ till date) adds to its uniqueness. IGPI has a JV with Japan Bank of International Cooperation (JBIC) – one of JV’s initiative is a VC fund in Europe (EUR 100mn fund) with participation from Honda, Panasonic and Omron.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.

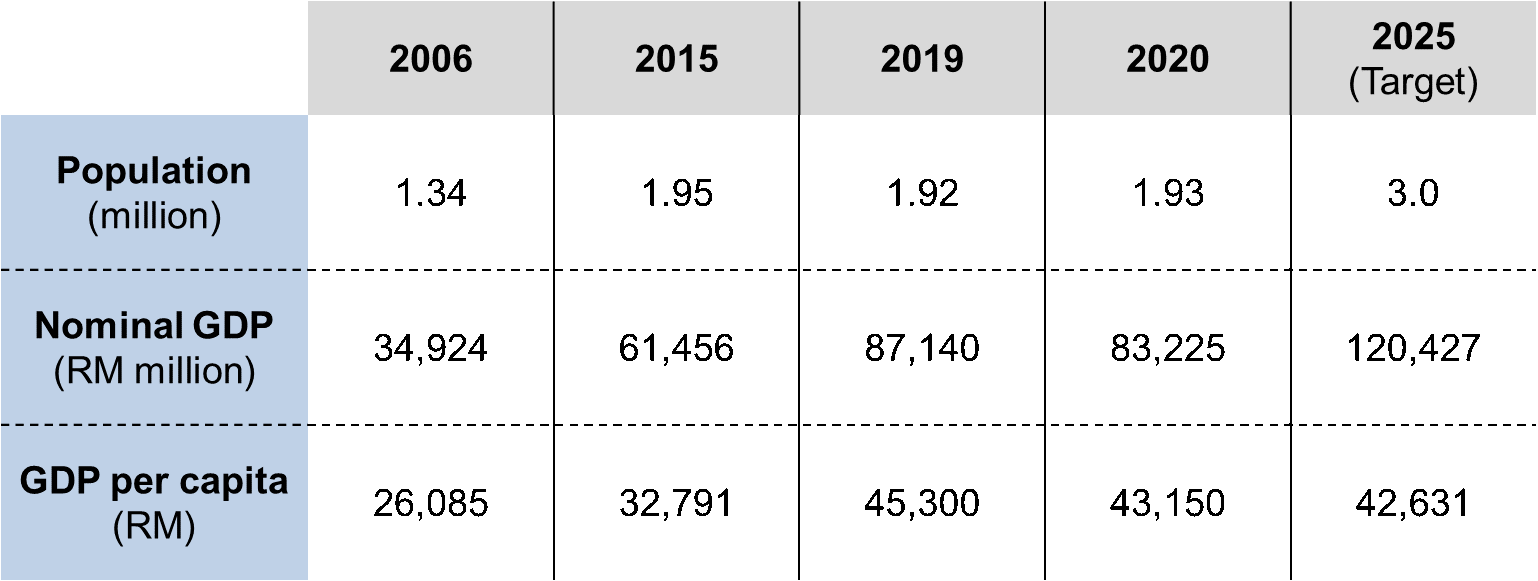

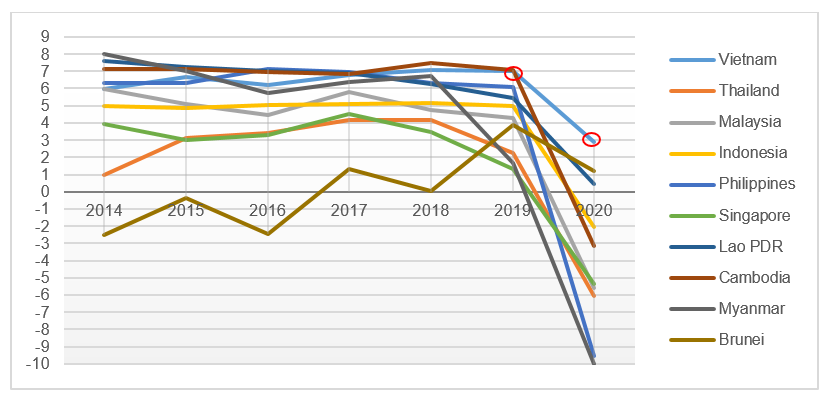

Iskandar Malaysia is the main southern development corridor in Johor, Malaysia. It is one of five priority regional development projects promoted by the Malaysian government since 2006. Iskandar Malaysia’s plan aims to develop the economy of the southern part of the state with a population of 3 million and a nominal GDP of RM120.4 billion by 2025. However, as of 2020, the population had only increased to 1.93 million while the nominal GDP had grown to 83,225 million, according to Iskandar Regional Development Authority (IRDA). [Refer to chart 1]

One of the reasons for the stagnation of growth is the impact from the coronavirus disease (COVID-19). The border closure as well as the inter-state movement control order have halted the flow of foreigners and Malaysians into the region, impacting industries including retail and tourism. The real estate market has also been hit hard by declining demand for luxury condominiums and land. However, since the restrictions have been lifted, the flow of people has recovered, signs of economic recovery have begun to appear, and progress has begun to be made in the plan.

The investment sector in Johor is divided into three sector categories, namely the primary sector (i.e. agricultural and plantation & commodities), the manufacturing sector (i.e. chemicals, electronics, etc.) and the service sector (i.e. information & communication, real estate, etc.).

The top two investors in Iskandar Malaysia from 2006 to 2021 are China and Singapore, with inflows of RM54.9 billion and RM25.1 billion, respectively, followed by US and Japan, according to IRDA.

Johor received RM70.6 billion worth of investments in 2022, the highest amount recorded in the past decade and the highest among all of the states in Malaysia in 2022. These investments are primarily from multinational companies seeking to diversify their operations to other countries as they adopt a China-plus-one strategy amid the trade war, according to the Johor’s State Investment, Trade and Consumer Affairs Committee chairman.

The majority of the recent investments in Johor have been in the service industry, including technology-intensive projects like hyper-scale data centers (HDCs). The reason for this focus is attributed to Johor’s availability of land and utilities capacity, which makes it suitable for supporting the funding and infrastructure requirements of such projects. The state is a hot spot for large tech players with operations in Singapore to set up data centers in the Johor for a couple of reasons – lower construction cost for data centers, affordable access to large-capacity energy, wholesale high-speed data connections and their close proximity with Singapore to support their business, all without compromising the time lag in data transmission. As such, the state’s favorable conditions demonstrate the region’s potential for new business creation in Southeast Asia (SEA). With the right management consulting support and strategic planning, Johor can leverage these advantages to attract even more investments and foster new business growth in the area.

The investments in Johor could also have a positive ripple effect that can help mitigate the issue of unsold residential properties due to an increase in employment opportunities. In April 2023, the Prime Minister announced that Malaysia received an investment return of RM170 billion from Chinese investors, witnessing the highest investment in history. Of China’s total commitment, an estimated RM80 billion will be invested for the petrochemical refinery in Pengerang, Johor. Further investment inflows in Johor are also likely to soar in 2023 as the state government is in active discussions with more companies involved in petrochemicals, pharmaceuticals and data centers to move their operations there.

To fully capitalize on the potential for new business creation in SEA, Malaysia must address two key issues affecting the progress of further economic development in Johor, which are brain drain to Singapore and connectivity with Singapore.

One key factor impeding growth in Johor is the outflow of talent to Singapore. In fact, a total of 1.13 million out of 1.86 million Malaysians who have migrated overseas are residing in Singapore as of 2022, according to the Malaysian Human Resources Minister. The demand for skilled labor will increase in tandem with the inflow of tech-intensive investments in Johor, thus the state government would need to address the issues of talent retention and attraction back into Malaysia, including nudging local industries to offer higher wages to entice Malaysians currently employed in Singapore.

Secondly, making progress with the longstanding connectivity challenges in Singapore, especially in terms of traffic congestion at the Woodlands Causeway and Tuas Second Link (the two land crossings across the Straits of Johor connecting Singapore and Malaysia), is another key aspect that can aid Iskandar Malaysia’s growth. Massive traffic jams are norms at one of the busiest land borders in the world which could often make a usual 30-minute journey an agonizing 3 hours or even longer. Reducing congestion is a key priority for the state government since it would have a “multiplier effect” on investment, jobs and the economy.

To improve connectivity, foster people-to-people ties and generate shared economic and social benefits between Johor, Malaysia and Singapore, the two governments are working on Johor Bahru – Singapore Rapid Transit System (RTS) Link. The RTS Link will cross the Straits of Johor via a 25m-high bridge from Woodlands North Station in Singapore to the Bukit Chagar Station in Johor Bahru. When commencing passenger service by end-2026, the RTS Link will be a standalone Light Rail Transit (LRT) System with the capacity to serve up to 10,000 commuters during peak periods, for every hour and in each direction, and it is anticipated to help lessen traffic congestion as well as the stress associated with cross-border travel.

When fully operational, the faster and easier commute between the two countries will benefit the local economy in Johor. One industry expected to benefit from the RTS Link is real estate. During the height of the property boom in Iskandar Malaysia from 2010 to 2013, many Singaporeans bought residential properties in the hopes of flipping them for investment gains or even using them as a second home. The RTS Link will be seen as a major boost for these property owners, who can now expect a stress-free cross-border journey, as well as for new owners looking to find reasonable housing options in Johor and commute back and forth for work and study in Singapore. Other than the real estate industry, tourism, retail, education, medical industries in Johor are also expected to benefit from the RTS Link.

While the RTS Link certainly benefits the local economy in Johor, the game-changing transport system will potentially accelerate the issue of brain drain to Singapore. There are reportedly over 300,000 Malaysians commuting daily for work in Singapore. Currently a large number of them travel by chartered bus or private motor vehicle but as the journey between the two countries is made more convenient, more Johoreans might look for employment in Singapore commuting via the RTS Link.

There is a delicate line between increased connectivity to Singapore and brain drain, and Iskandar Malaysia will need to find the balance and tackle these issues in tandem. That being said, the state government, in collaboration with management consulting experts, should develop comprehensive strategies to maximize the benefits of the RTS Link while ensuring that Johor retains its skilled workforce and nurtures a conducive environment for new business creation in SEA.

Media reports in the past referred to Johor as potentially the next Shenzhen of Malaysia and as a possible New Jersey to Singapore’s Manhattan. With a strong focus on innovation, strategic partnerships, emerging sectors, and talent development, Johor has the potential to establish itself as a leading hub for new business creation in SEA, enhancing its economic growth and integration with Singapore. And as connectivity is one of the key factors to economically integrate people in these cities for reasons including trade, investment, and tourism, we will pay close attention to the new RTS Link and its impact on future developments between Johor and Singapore.

*This article is based on the lecture IGPI Singapore gave to the Japanese business community in Johor Bahru in April 2023. IGPI Singapore provides management consulting services to companies including new business development, talent acquisition and retention, and restructuring of offices, factories, and logistics facilities which appear to be urgent problems to tackle in companies based in Johor, Malaysia. As a premier management consulting firm, IGPI Singapore can help businesses identify lucrative opportunities and develop tailored strategies to enter Asian markets, make structural improvements and more. To find out more about us, browse through our insight articles or get in contact with us.

****************************************************************************************************

Mr. Ryota Yamazaki is the Director of IGPI Singapore. Before joining IGPI, Ryota worked in Deloitte Consulting in Singapore, where he was a leader in the areas of Consumer Business and Supply Chain & Logistics in Southeast Asia. His areas of expertise are Strategy & Operations such as market entry, Route-to-Market (RTM) strategy, business due diligence, and PMI. He started his career with A.P. Moller-Maersk Group as a management trainee and also worked for Kurt Salmon, where he had vast project experiences especially in Supply Chain & Logistics for the retail and consumer goods clients. Ryota graduated from the Faculty of Economics at Keio University.

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with presence and coverage across Asian markets. IGPI was established by former members of Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around fund supported by the Japanese government.

IGPI has vast experience of supporting Fortune 500s, Govt. agencies, universities, SMEs and startups across Asia and beyond for their strategic business needs such as market entry and growth strategies, various aspects of M&A, innovation advisory, new business creation etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with it making its own venture investments (30+ till date) adds to its uniqueness. IGPI has a JV with Japan Bank of International Cooperation (JBIC) – one of JV’s initiative is a VC fund in Europe (EUR 100mn fund) with participation from Honda, Panasonic and Omron.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.

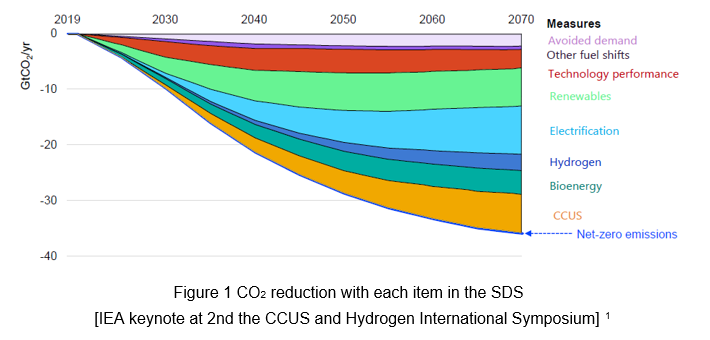

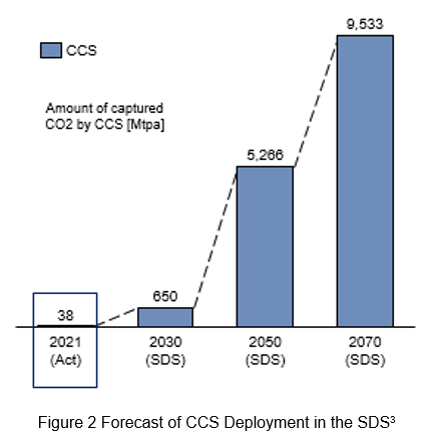

One reason for the emphasis on CCUS is that there are unique values in CCUS that are difficult to achieve it with other CO2 reduction methods. Specifically, according to the IEA, there are mainly four strategic values of CCUS:

One reason for the emphasis on CCUS is that there are unique values in CCUS that are difficult to achieve it with other CO2 reduction methods. Specifically, according to the IEA, there are mainly four strategic values of CCUS: Most of the current CCS development projects in operation are mainly in Europe and the U.S., whereas in Southeast Asia region, there are no commercialized CCS projects that are in operation phase at present. Major reason for this situation is that the legal system related to CCS is still underdeveloped in Southeast Asia, while Europe and the U.S. have incentivized initiatives such as the Emission Trading System and Tax Credit (45Q). As a result, it is difficult for project developers to invest in PJ development because they have no prospect of its profitability at this point.

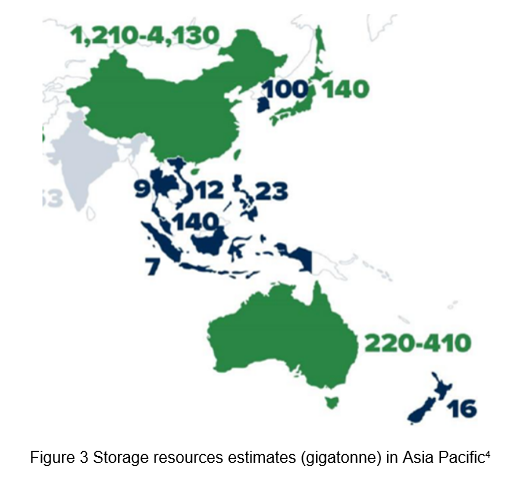

Most of the current CCS development projects in operation are mainly in Europe and the U.S., whereas in Southeast Asia region, there are no commercialized CCS projects that are in operation phase at present. Major reason for this situation is that the legal system related to CCS is still underdeveloped in Southeast Asia, while Europe and the U.S. have incentivized initiatives such as the Emission Trading System and Tax Credit (45Q). As a result, it is difficult for project developers to invest in PJ development because they have no prospect of its profitability at this point.  Japanese government and companies have started to promote the development of CCS projects in Southeast Asia against this high potential. For example, in the Gundhi CCS Project in Indonesia, JGC HOLDINGS CORPORATION and Electric Power Development Co., Ltd. are collaborating with Pertamina and the Bandung Institute of Technology to develop the first large-scale CCS project in ASEAN, and the number of similar projects is expected to increase in the future.

Japanese government and companies have started to promote the development of CCS projects in Southeast Asia against this high potential. For example, in the Gundhi CCS Project in Indonesia, JGC HOLDINGS CORPORATION and Electric Power Development Co., Ltd. are collaborating with Pertamina and the Bandung Institute of Technology to develop the first large-scale CCS project in ASEAN, and the number of similar projects is expected to increase in the future.  Mr. Tatsushi Sasakura is a Senior Manager of IGPI Singapore. Tatsushi has worked in Mizuho Bank and Deloitte Tohmatsu Financial Advisory (DTFA) in Japan. At DTFA, he belonged to the Corporate Strategy team specializing in business strategy planning, M&A advisory, and business due diligence. He was also engaged in crisis management, supporting clients to tackle emergencies. He has profound experience in the energy, consumer, and financial industries. He covered a wide range of clients including Private Equity Funds and large-sized companies. Tatsushi graduated from Waseda University with a B.A. in International Political Science and Economy.

Mr. Tatsushi Sasakura is a Senior Manager of IGPI Singapore. Tatsushi has worked in Mizuho Bank and Deloitte Tohmatsu Financial Advisory (DTFA) in Japan. At DTFA, he belonged to the Corporate Strategy team specializing in business strategy planning, M&A advisory, and business due diligence. He was also engaged in crisis management, supporting clients to tackle emergencies. He has profound experience in the energy, consumer, and financial industries. He covered a wide range of clients including Private Equity Funds and large-sized companies. Tatsushi graduated from Waseda University with a B.A. in International Political Science and Economy.

Mr. Ryota Yamazaki is the Director of IGPI Singapore. Before joining IGPI, Ryota worked in Deloitte Consulting in Singapore, where he was a leader in the areas of Consumer Business and Supply Chain & Logistics in Southeast Asia. His areas of expertise are Strategy & Operations, such as market entry, Route-to-Market (RTM) strategy, business due diligence, and PMI. He started his career with A.P. Moller-Maersk Group as a management trainee and also worked for Kurt Salmon, where he had vast project experience, especially in Supply Chain & Logistics for the retail and consumer goods clients. Ryota graduated from the Faculty of Economics at Keio University.

Mr. Ryota Yamazaki is the Director of IGPI Singapore. Before joining IGPI, Ryota worked in Deloitte Consulting in Singapore, where he was a leader in the areas of Consumer Business and Supply Chain & Logistics in Southeast Asia. His areas of expertise are Strategy & Operations, such as market entry, Route-to-Market (RTM) strategy, business due diligence, and PMI. He started his career with A.P. Moller-Maersk Group as a management trainee and also worked for Kurt Salmon, where he had vast project experience, especially in Supply Chain & Logistics for the retail and consumer goods clients. Ryota graduated from the Faculty of Economics at Keio University.

Mr. Zhi Hao Thean is an Analyst in IGPI Singapore. Zhi Hao started his career with IGPI. He graduated from Singapore Management University with a Bachelor of Business Management, majoring in Finance. During his penultimate year, Zhi Hao embarked on an internship in Corporate Advisory, where he was engaged in M&A, financial due diligence, and valuation projects across various industries. He also worked as a Research Assistant at SMU, where he performed academic research on real estate investment trusts. Zhi Hao is proficient in English and Mandarin. He enjoys keeping up with the latest developments in consumer technology such as smartwatches and mobile operating systems in his free time.

Mr. Zhi Hao Thean is an Analyst in IGPI Singapore. Zhi Hao started his career with IGPI. He graduated from Singapore Management University with a Bachelor of Business Management, majoring in Finance. During his penultimate year, Zhi Hao embarked on an internship in Corporate Advisory, where he was engaged in M&A, financial due diligence, and valuation projects across various industries. He also worked as a Research Assistant at SMU, where he performed academic research on real estate investment trusts. Zhi Hao is proficient in English and Mandarin. He enjoys keeping up with the latest developments in consumer technology such as smartwatches and mobile operating systems in his free time.

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with a presence and coverage across Asian markets. IGPI was established by former members of the Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around funds supported by the Japanese government. In 2017, IGPI collaborated with Japan Bank for International Cooperation (JBIC) to form JBIC IG, providing investment advisory services and supporting overseas investment. In 2019, JBIC along with BaltCap jointly established Nordic Ninja, a €100 million venture capital fund to focus on deep tech sectors such as autonomous mobility, digital health, AR/VR/MR, artificial intelligence, robotics and IoT in the Nordic and Baltic region. In 2019, IGPI established IGPI Technology to focus on the area of science and technology. The company invests in technological ventures and provides hands-on management support. The company also provides business development support for the commercialisation and monetization of technologies. IGPI Australia is a branch office of IGPI Singapore. The latter, which was established in 2013, focuses on management consulting and M&A advisory in Southeast Asia across various sectors. We act as a bridge between Japan and wider APAC, having advised on market entry strategy, potential target search, valuation, due diligence, M&A process management, post-merger integration and change management for leading Japanese clients. In addition, we have helped businesses in Southeast Asia enter Japan and acted as sell-side advisors for SMEs and private equity funds looking to divest. IGPI Australia was established in 2020 with a dual focus of helping Australian businesses enter and grow in ASEAN / Japan and attracting Japanese investments into Australia. We have since successfully helped to connect multiple Australian businesses with Japanese businesses within IGPI’s network.

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with a presence and coverage across Asian markets. IGPI was established by former members of the Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around funds supported by the Japanese government. In 2017, IGPI collaborated with Japan Bank for International Cooperation (JBIC) to form JBIC IG, providing investment advisory services and supporting overseas investment. In 2019, JBIC along with BaltCap jointly established Nordic Ninja, a €100 million venture capital fund to focus on deep tech sectors such as autonomous mobility, digital health, AR/VR/MR, artificial intelligence, robotics and IoT in the Nordic and Baltic region. In 2019, IGPI established IGPI Technology to focus on the area of science and technology. The company invests in technological ventures and provides hands-on management support. The company also provides business development support for the commercialisation and monetization of technologies. IGPI Australia is a branch office of IGPI Singapore. The latter, which was established in 2013, focuses on management consulting and M&A advisory in Southeast Asia across various sectors. We act as a bridge between Japan and wider APAC, having advised on market entry strategy, potential target search, valuation, due diligence, M&A process management, post-merger integration and change management for leading Japanese clients. In addition, we have helped businesses in Southeast Asia enter Japan and acted as sell-side advisors for SMEs and private equity funds looking to divest. IGPI Australia was established in 2020 with a dual focus of helping Australian businesses enter and grow in ASEAN / Japan and attracting Japanese investments into Australia. We have since successfully helped to connect multiple Australian businesses with Japanese businesses within IGPI’s network.

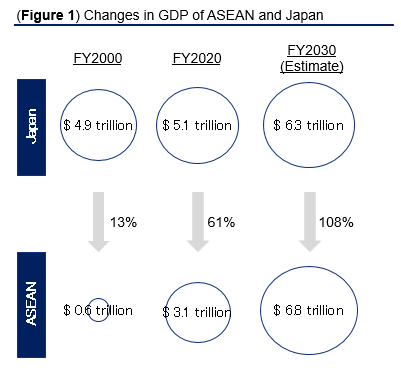

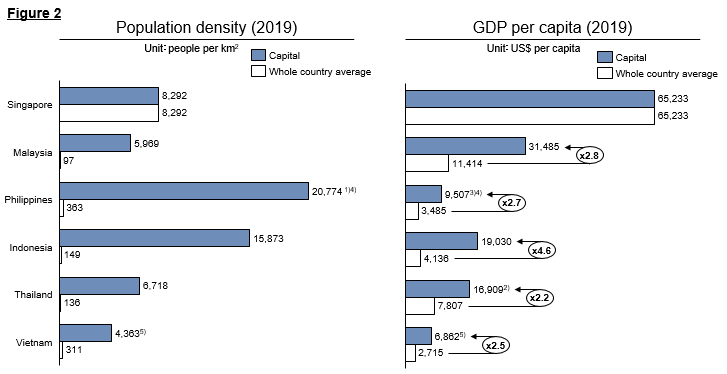

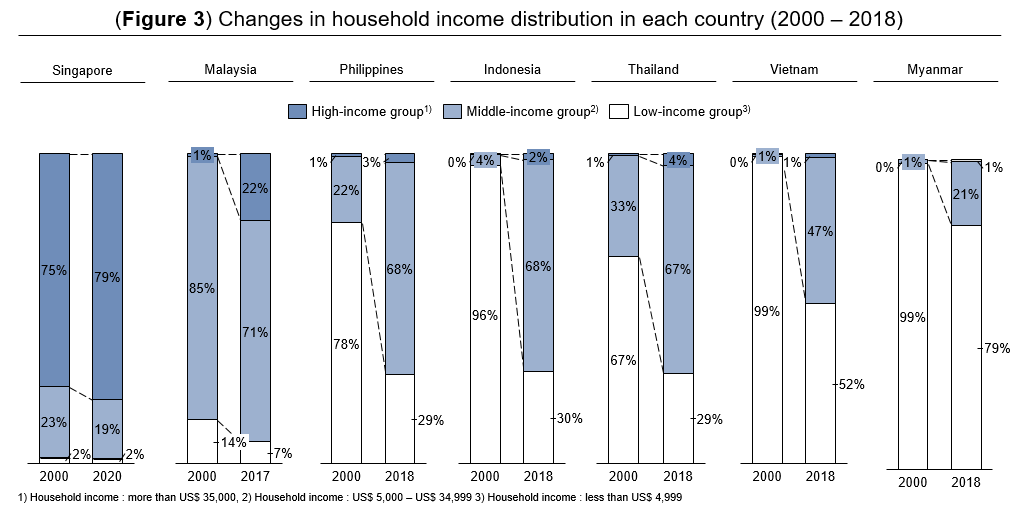

In ASEAN, along with the urbanization, in which more and more people gather in cities, the ratio of the middle class is increasing in many countries, promoting economic development in the area. In many ASEAN countries, the ratio of middle-class or higher households is more than 50% nowadays. It is even expected that not only the middle class but also the wealthy class will increase in the future (see Figure2[2], 3[3]).

In ASEAN, along with the urbanization, in which more and more people gather in cities, the ratio of the middle class is increasing in many countries, promoting economic development in the area. In many ASEAN countries, the ratio of middle-class or higher households is more than 50% nowadays. It is even expected that not only the middle class but also the wealthy class will increase in the future (see Figure2[2], 3[3]).

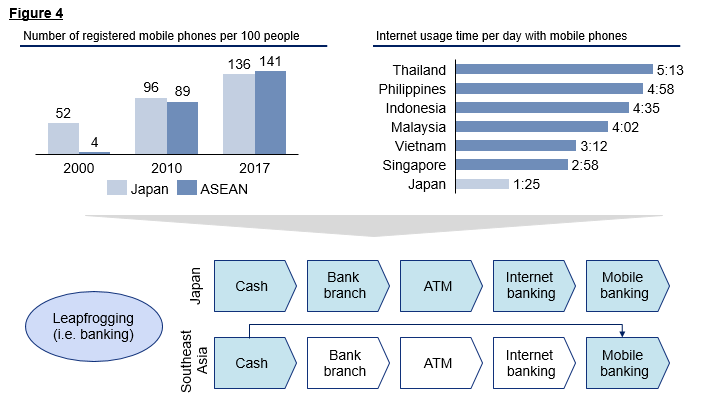

Furthermore, in ASEAN, the penetration rate of smartphones is increasing more rapidly than in developed countries such as Japan, and people in ASEAN use smartphones much more frequently and longer a day compared to people in Japan. As a result, the leapfrogging (accelerating development by skipping inferior, less efficient, more expensive or more polluting technologies and industries, and moving directly to more advanced ones) has also occurred, and the business environment has changed significantly (see Figure 4[4]).

Furthermore, in ASEAN, the penetration rate of smartphones is increasing more rapidly than in developed countries such as Japan, and people in ASEAN use smartphones much more frequently and longer a day compared to people in Japan. As a result, the leapfrogging (accelerating development by skipping inferior, less efficient, more expensive or more polluting technologies and industries, and moving directly to more advanced ones) has also occurred, and the business environment has changed significantly (see Figure 4[4]).  The rapid changes mentioned above have given not only opportunities in the growing market, but also opportunities from the rising demand for solutions to various social issues such as traffic congestion, medical shortages, and lack of service quality. However, amid such rapid changes, the ability related to exploration is required more than before. It mainly consists of the creativity to make a new business concept through careful observation of the site, and the agility to repeat the planning and verification of new business hypotheses at high speed. In response to these changes, emerging digital and tech companies such as Grab and Go To (Gojek & Tokopedia) are achieving continuous transformation and growth while developing new businesses one after another through quick top-down decision making, etc in Singapore and other countries in Southeast Asia.

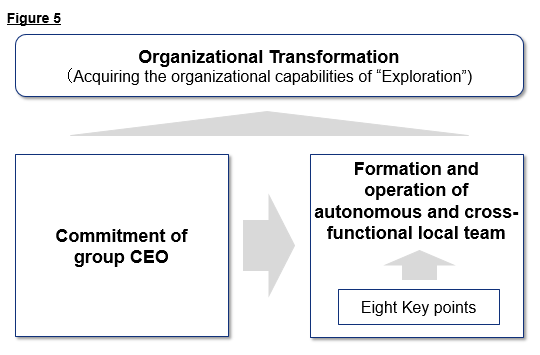

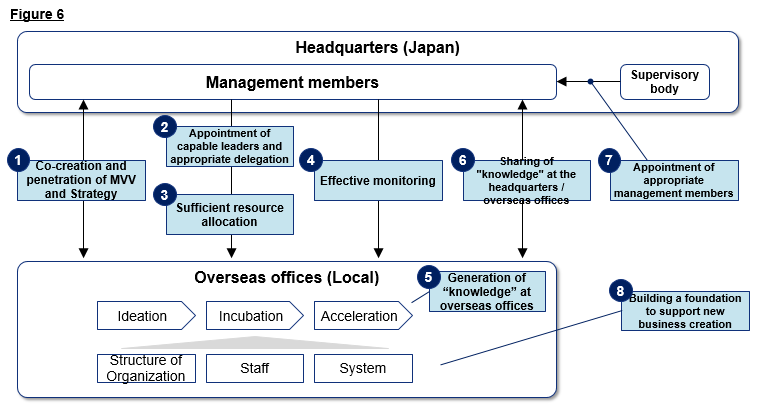

The rapid changes mentioned above have given not only opportunities in the growing market, but also opportunities from the rising demand for solutions to various social issues such as traffic congestion, medical shortages, and lack of service quality. However, amid such rapid changes, the ability related to exploration is required more than before. It mainly consists of the creativity to make a new business concept through careful observation of the site, and the agility to repeat the planning and verification of new business hypotheses at high speed. In response to these changes, emerging digital and tech companies such as Grab and Go To (Gojek & Tokopedia) are achieving continuous transformation and growth while developing new businesses one after another through quick top-down decision making, etc in Singapore and other countries in Southeast Asia.  The first is to form and operate an autonomous and cross-functional local team. If the headquarters empower the local team and it can engage in various activities related to creating new business autonomously by itself, the agility of the team will be improved. In addition, by increasing the diversity of the organization (adding members with various backgrounds to the team), it is possible to easily conceptualize business plans from a new perspective, and even if they encounter problems, they will be able to come up with the ideas of solutions from various angles. The other is for the group CEO to commit to ensure that such a local team is formed and operated properly. Since the nature of exploitation of existing businesses and exploration for new businesses are different, there are often conflicts in terms of resources, etc., and it is often required that the CEO take the initiative in providing support to the local team. Then, what should be done to realize the formation and operation of an autonomous and cross-functional local team? There are eight key factors (see Figure 6).

The first is to form and operate an autonomous and cross-functional local team. If the headquarters empower the local team and it can engage in various activities related to creating new business autonomously by itself, the agility of the team will be improved. In addition, by increasing the diversity of the organization (adding members with various backgrounds to the team), it is possible to easily conceptualize business plans from a new perspective, and even if they encounter problems, they will be able to come up with the ideas of solutions from various angles. The other is for the group CEO to commit to ensure that such a local team is formed and operated properly. Since the nature of exploitation of existing businesses and exploration for new businesses are different, there are often conflicts in terms of resources, etc., and it is often required that the CEO take the initiative in providing support to the local team. Then, what should be done to realize the formation and operation of an autonomous and cross-functional local team? There are eight key factors (see Figure 6).

Jongwoo has worked in ABeam Consulting Ltd, where he engaged in various consulting projects including the development of business plans, creating go-to-market strategy, and hands-on support in several B2B industries such as energy, automotive, ve, IT, etc. He not only develops strategy but also supports clients’ execution of the plan, such as searching for strategic alliance partners and approaching them. He started his career as an auditor in KPMG Japan, leading an audit team for foreign investment banks, and also provided regulation-related advisory services to Japanese financial institutions. He has a bachelor’s degree in economics from the University of Tokyo.

Jongwoo has worked in ABeam Consulting Ltd, where he engaged in various consulting projects including the development of business plans, creating go-to-market strategy, and hands-on support in several B2B industries such as energy, automotive, ve, IT, etc. He not only develops strategy but also supports clients’ execution of the plan, such as searching for strategic alliance partners and approaching them. He started his career as an auditor in KPMG Japan, leading an audit team for foreign investment banks, and also provided regulation-related advisory services to Japanese financial institutions. He has a bachelor’s degree in economics from the University of Tokyo.  Industrial Growth Platform Inc. (IGPI) is a premium Japanese management consulting and M&A advisory firm headquartered in Tokyo with offices in Singapore, Hanoi, Shanghai, and Melbourne. IGPI has 14 institutional investors, including prominent Japanese mega-corporations such as Nomura Holdings, SMBC, KDDI, Recruit, and Sumitomo Corporation to name a few. IGPI has vast experience in supporting Fortune 500s, Govt. agencies, universities, SMEs, and startups across Asia and beyond for their strategic business needs such as market entry and digital transformation and growth strategies, various aspects of M&A, innovation advisory, new business creation, etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with its making its venture investments (30+ till date) adds to its uniqueness. IGPI has a JV with the Japan Bank of International Cooperation (JBIC) – one of JV’s initiatives is a VC fund in Europe (EUR 100mn fund) with participation from Honda, Panasonic, and Omron. Get in touch with us on internationalization, strategic planning, and fundraising-related topics!

Industrial Growth Platform Inc. (IGPI) is a premium Japanese management consulting and M&A advisory firm headquartered in Tokyo with offices in Singapore, Hanoi, Shanghai, and Melbourne. IGPI has 14 institutional investors, including prominent Japanese mega-corporations such as Nomura Holdings, SMBC, KDDI, Recruit, and Sumitomo Corporation to name a few. IGPI has vast experience in supporting Fortune 500s, Govt. agencies, universities, SMEs, and startups across Asia and beyond for their strategic business needs such as market entry and digital transformation and growth strategies, various aspects of M&A, innovation advisory, new business creation, etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with its making its venture investments (30+ till date) adds to its uniqueness. IGPI has a JV with the Japan Bank of International Cooperation (JBIC) – one of JV’s initiatives is a VC fund in Europe (EUR 100mn fund) with participation from Honda, Panasonic, and Omron. Get in touch with us on internationalization, strategic planning, and fundraising-related topics! This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness, and accuracy of such information. All rights reserved by IGPI.

SUNRICE – One of Australia’s leading food exporters with 30 brands in 50 countries About the company : One of the largest rice food companies in the world and one of Australia’s leading branded food exporters Mode of entry : In 2018, SunRice accomplished the acquisition of a rice processing mill in Dong Thap Province to establish a fully vertical integrated supply chain in Vietnam. How it solved issues : The investment helps to introduce advanced production know-how accompanying agronomic expertise to upskill and improve the quality, safety standards and reputation of Vietnam’s rice exports. |

| CBH Group – Western Australian grain grower co-operative About the company : grain grower’s cooperative that handles, markets and processes grain from the wheat belt of Western Australia Mode of entry : Created a joint venture (Interflour Group) with another regional player through the acquisition of six flour mills in Indonesia, Malaysia and Vietnam12. How it solved issues : Using grain from Australian and around the world, Interflour supplies better quality flour to Vietnam domestic market for baking, noodle and confectionery production and malt to supply Vietnam’s drinks industry |

| Icon Group – Australia’s largest dedicated cancer care provider About the company : Reshaped cancer care by integrating distinct treatment disciplines. It has expanded globally, including some Asian countries such as Singapore, China and Hong Kong16. Mode of entry : Entered partnerships with two of Vietnam’s leading healthcare providers – The National Cancer Hospital in Hanoi (the K Hospital) and the Military 175 Hospital in Ho Chi Minh City. How it solved issues : The partnership helped upgrade Vietnam’s cancer care infrastructure to a larger scale, applying an international standard in medical excellence across hospital management and utilise innovative technologies to provide remote care as necessary17. They have also brought in experts from Icon Group’s Australian and Singaporean businesses to assist the Vietnamese healthcare providers. |

|

| Raiz Invest Limited – an Australian fintech startup About the company : Australian fintech startup operating in Australia, Indonesia and Malaysia that allows customers to round-up everyday purchases and pool their spare change to invest in equities, bonds and other securities. Mode of entry : It is expected for Raiz to enter into strategic partnership with a local player similar to their strategy in Malaysia where they partnered with a local unit trust player How it can solve issues : Raiz provides a platform that increases the access to capital for the users (e.g. access to larger sum of money for investment). |

| RMIT University – an internationally recognised Australian university of technology, design and enterprise About the company: Innovative university in Melbourne, recognized for its study and research in technology, design and enterprise23. Mode of entry: In 2001, RMIT entered Vietnam by investing directly and opening its first campus in HCMC with services and facilities mirroring the Melbourne campus. A second campus opened in Hanoi in 2004 and in 2017, an English language centre opened in Da Nang. How it solves: RMIT Vietnam is assisting in the development of human resources capability in Vietnam. Degrees are awarded by RMIT University in Australia, allowing Vietnamese students to receive an overseas education without having to leave home. |

| English Learning Company (ELC) – an Australian award-winning English language school About the company: ELC offers a range of major English courses which are supplemented by a choice of electives. ELC has partnerships with a number of Australian universities and education providers. Mode of entry: In 2017, ELC entered Vietnam via a partnership with HUTECH University (Vietnam) to establish ELC Vietnam in HCM City to meet the demand for English in Vietnam. How it solved issues: Operating as a private English language centre, ELC Vietnam aims to provide students with a quality on-campus option for English language lessons. ELC works with a number of educational organisations in Vietnam to offer a paid teaching internship working in local primary and high schools with competitive prices for all English programmes. |

Kohki Sakata Chief Executive Officer +65 81682503 k.sakata@igpi.co.jp

Rachit Khosla Country Manager – Australia +61 414 433 572 r.khosla@igpi.co.jp This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI. __________________________________________________________________________________________

Rachit Khosla Country Manager – Australia +61 414 433 572 r.khosla@igpi.co.jp This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI. __________________________________________________________________________________________

1. Validating that the idea is feasible with lesser resources involved Companies undertake various steps to test the solution before fully committing to the development and production of the final product. These steps include the PoC, Prototype and Minimum Variable Product (MVP). PoC is one of the first steps undertaken to ensure the idea is practical and feasible at a reasonable cost. It is also completed within a relatively shorter timeframe than a prototype or MVP. (Note: PoCs validate the feasibility of an idea, while prototypes are made to demonstrate how the idea can be developed.)

2. Uncovering potential issues and obstacles during the product launch PoCs help to identify any potential problems that might occur when production or implementation takes place. Potential problems can be related to technical, legal or functional aspects or the like. They should be resolved before the product is launched in the market. By conducting a PoC, companies are able to identify risks and obstacles and find ways to eliminate, mitigate and address these problems. This increases the likelihood of success when launching the products.

3. Helps to determine chances for scalability When proposing an idea on a new solution to key management, one of the main questions frequently asked will likely include: “how scalable is the end product?”. Through a PoC, companies can understand if the proposed solution complements their current product portfolio, or can be sold to different customers across different categories, geographical region, etc.

A PoC can also help companies assess their current capacity and capabilities in meeting the escalating demand of the products. It prompts companies to reflect on how to go about growing and mass-producing the product taking into consideration things like production capability, human resources, workflow standardization, among other things. This results in better planning and preparation for the production stage.

4. Helps gain funding from stakeholders After the PoC is conducted, the project team can better illustrate the usability and profitability of the idea to the stakeholders. They can support the idea of the new solution in detail with illustrations and sufficient data. A PoC serves as evidence to stakeholders that the idea proposed is practical, attractive for the target market, and achievable for the company. It helps to convince stakeholders that the investment is worthy, and to get their approval for more resources and funding to develop the proposed idea.

Kohki Sakata Chief Executive Officer