A key strategic thrust is renewable energy development, with a goal for renewables to contribute 75% of the country’s electricity capacity by 20401. Among these renewable resources, Indonesia’s geothermal potential stands out, with abundant resources located at 362 sites throughout Indonesia2. This potential is particularly promising for supporting the nation’s decarbonization goals, as geothermal energy offers a reliable and sustainable source of power.

This article will explore Indonesia’s geothermal potential, the challenges of greenfield development, opportunities for Mergers and Acquisitions (M&A) investment in the sector, and how IGPI can support private and public companies to capitalize on these opportunities.

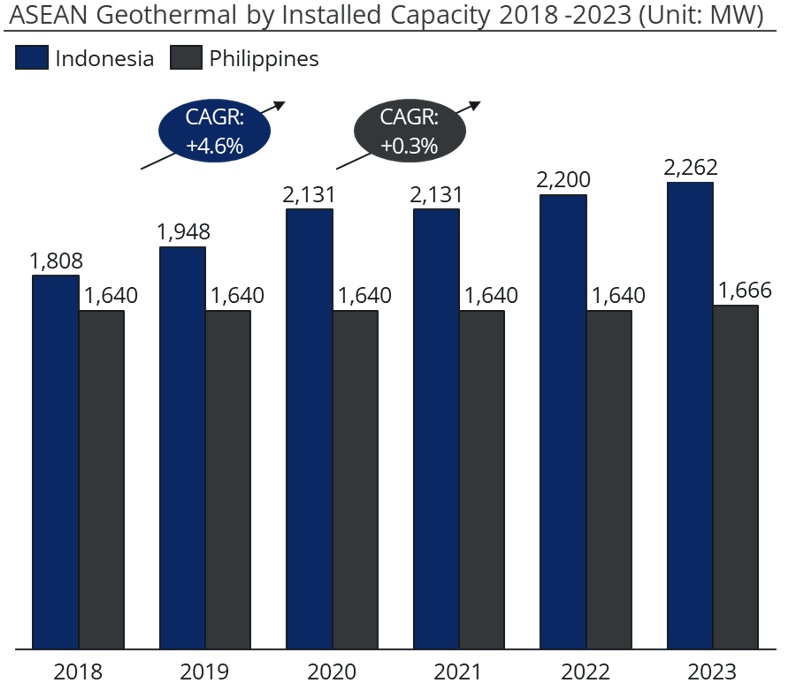

Within ASEAN today, two countries lead in geothermal capacity: Indonesia and the Philippines. While both nations boast abundant potential, Indonesia’s geothermal potential has seen more rapid growth in this area over the last five years. However, despite this potential, the development of geothermal energy in Indonesia is fraught with significant challenges, especially during the exploration phase, which presents obstacles to sustained greenfield development.

In ASEAN, the total geothermal potential capacity amounts to 34 gigawatts (GW), concentrated primarily in Indonesia and the Philippines. Over the past five years, Indonesia has emerged as the leading developer of geothermal power in the region, achieving an annual growth rate of 4.6% compound annual growth rate (CAGR) from 2018 to 2023, while the Philippines has seen minimal growth at just 0.3% CAGR over the same period3.

As of 2023, Indonesia has installed about 2.28 GW of geothermal capacity, representing only around 8% of its total geothermal potential of 30 GW. According to the General Plan for National Energy (RUEN), Indonesia aims to achieve 7.24 gigawatts of geothermal power by 2025, requiring an investment of approximately US$15 billion, and to reach 9.3 gigawatts by 2035. This plan highlights significant opportunities for future development in Indonesia’s geothermal potential.

Yet, two key obstacles hinder the development of greenfield geothermal projects in the country: high exploration risks and challenges in securing licensing and land clearance.

1) High Exploration Risk

The primary challenge in developing new greenfield geothermal projects is the substantial risk associated with exploration, requiring substantial investments ranging from 3 to 5 million USD/MW4 and carrying considerable uncertainty in finding viable geothermal sources. The government has implemented measures to mitigate these risks, including support for drilling, soft loans, and exploration funding through initiatives such as the Geothermal Sector Infrastructure Financing Scheme (PISP) and Geothermal Resource Risk Mitigation (GREM)5. However, these incentives have seen limited uptake due to a combination of factors, including insufficient tariffs on electricity produced and high-interest rates that increase the required return on investment.

2) Challenges in Licensing and Land Clearance Procedures

Despite the government’s introduction of a one-stop licensing system and the designation of geothermal projects as National Strategic Projects (PSN), practical challenges remain. Exploration and subsequent development often overlap with, and potentially conflict with, other environmental legislation, such as protected land/forest areas. Deconstructing and organizing these policies will take time; until then, many exploration permits will require long waiting periods for approval or may fail after multiple rounds of submission and clearance.

Given the challenges associated with greenfield projects, a brownfield approach—specifically via geothermal M&A—has become an attractive entry option for many developers and investors seeking to enter this sector. This strategy has particularly resonated with Japanese entities; to date, there are 7 Japanese entities involved in geothermal projects in Indonesia, with 5 of these entering via M&A. Between 2007 and 2023, there were approximately 15 M&A transactions in Indonesia’s geothermal industry6, 8 of which were executed by Japanese entities.

Among the 5 Japanese players in the market today, INPEX stands out. Since its entry in 2011, the company has primarily employed a brownfield strategy to rapidly expand its geothermal business in Indonesia. Through INPEX Geothermal Ltd., which primarily focuses on geothermal activities, the company has successfully completed four acquisitions7.

In 2015, INPEX made its inaugural brownfield investment by acquiring a 49% stake in Medco Power Indonesia, which in turn owns a 37.25% interest in the Sarulla Geothermal Project, joining a consortium that oversees one of the world’s largest single-contract geothermal power projects. To date, INPEX holds an 18% stake in the project.

In 2021, INPEX further expanded its portfolio by acquiring a 33.3% share from PT Supreme Energy Sumatera, which in turn owns a 30% interest in the Supreme Muara Laboh Geothermal Project, bringing the company’s ownership in this project to 10%. In 2022, INPEX further increased its stake from 10% to 30% by acquiring an additional 20% from another project shareholder, ENGIE SA. That same year, INPEX also completed an investment in the Supreme Energy Rantau Dedap Geothermal Project by acquiring a 27.4% stake from ENGIE SA.

Most recently, in 2023, INPEX joined the Supreme Energy Rajabasa Geothermal project in Lampung, acquiring a 31.45% stake from PT Supreme Energy Raja Basa. Through these strategic investments, INPEX is solidifying its position as a key player in Indonesia’s geothermal energy sector, contributing to the country’s efforts toward sustainable energy development.

Japanese entities have already begun their foray into the geothermal sector. The combination of a fragmented market landscape, characterized by numerous operating entities and relatively young geothermal facilities (with 60% being under 16 years old8), along with the apparent interest from local entities in seeking strategic partners to enhance technology and expand operations, highlights a market primed and ready for foreign private capital to spur growth.

IGPI Singapore specializes in supporting clients with M&A projects, conducting market research, and developing market entry strategies, particularly within the renewable energy sector.

To address these challenges, IGPI offers comprehensive M&A assessment services, including (not limited to):

◆ Target Screening (Pre-Due Diligence): We conduct thorough primary research to identify potential investments and shortlist viable targets.

◆ Due Diligence: Our team performs detailed commercial due diligence to gain a deeper understanding of potential targets, covering market analysis, business models, synergies, investment risks, and more.

These solutions are tailored to empower clients to make informed decisions and navigate complexities in their investment initiatives, ensuring strategic and successful market entries.

To find out more about how IGPI can provide consulting support for businesses, browse through our insight articles or get in contact with us.

1. Business Plan for Electricity Supply (RUPTL) PLN 2024-20

2. Center for Mineral, Coal, and Geothermal Resources (PSDMBP)

3. IRENA, Geothermal Energy Data

4. API – Indonesia Geothermal Association

5. API – Indonesia Geothermal Association, Webinar – Geothermal Added Value Creation Strategy as a Supportive Measure for NZE 2060

6. Merger Market

7. INPEX Corporation

8. Global Geothermal Tracker

Mr. Febrizal is the Associate of IGPI Singapore. Prior to joining IGPI, Febrizal worked at YCP Solidiance and PwC Indonesia, where he successfully completed a range of consulting projects, including market entry strategy, growth strategy, and business model identification, across diverse industries such as Agriculture, Automotive, and Industrial. He has extensive experience in M&A activities, including conducting commercial due diligence, valuations, and providing deal advisory services (connecting buy-side and sell-side). Febrizal holds a degree in Economics from Binus University.

Industrial Growth Platform Inc. (IGPI) is a Japan-rooted premium management consulting & investment firm headquartered in Tokyo with offices in Osaka, Singapore, Hanoi, Shanghai & Melbourne. IGPI was established in 2007 by former members of Industrial Revitalization Corporation of Japan (IRCJ), a USD 100 billion sovereign wealth fund focusing on turnaround projects in Japan. IGPI has 13 institutional investors, including Nomura Holdings, SMBC, KDDI, Recruit & Sumitomo Corporation, to name a few. IGPI has vast experience supporting Fortune 500s, government. agencies, universities, SMEs, and funded startups across Asia and beyond for their strategic business needs and hands-on support across a wide variety of industries. IGPI group has approximately 7,500 employees on a consolidated basis.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.