Food tech is booming all over the world, and one of the centers of this trend is Singapore.

Why are food tech companies so active in Singapore? The answer lies in aggressive policies put in place by the Singaporean government.

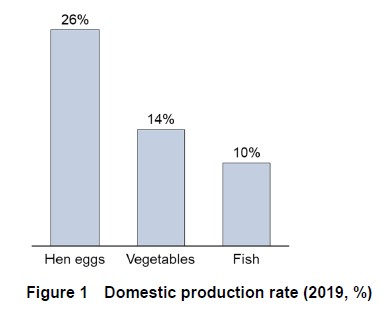

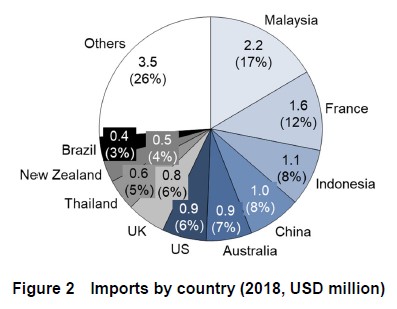

Singapore has the third highest population density in the world after Macau and Monaco. Around 5.8M people live on only 728 sq km land. Upon independence from Malaysia in 1965, Singapore’s economy rapidly transformed under the leadership of Lee Kuan Yew, the founding father of modern Singapore, by concentrating resources into industries generating high added value, such as manufacturing and finance. Agriculture was not the government’s first priority as an industry, and Singapore currently heavily relies on imports1 (Figure 1). Currently more than 90% of food consumed in Singapore are imports from 170+ countries1 (Figure 2).

Singapore faced a critical situation during Covid-19 regarding the country’s food security. In the early stages of the pandemic, some supermarket shelves were emptied as people rushed to buy instant food. The government worked with major supermarkets and food wholesalers to build up stocks of food and essential supplies. Singapore’s government also consulted with Malaysia’s government to ensure that food imports would continue even after the border closed at midnight on March 17, 2020. Concerns were thus lessened. Nonetheless, the pandemic reaffirmed the importance of food security.

On March 7, 2019, about a year before pandemic, Singapore’s government announced food security as one of the chief concerns to be addressed, and set three strategies to achieve food security for the nation:

1) Diversify import sources

2) Grow local

3) Grow overseas

The biggest challenge is “Grow local”. The government aims to achieve 30% of Singapore’s nutritional needs with food produced locally by 2030, a plan referred to as 30 by 301. Singapore Food Agency (SFA) provides financial support to aim for efficient and sustainable agriculture. The following examples demonstrate efforts by the Singaporean government to realize the “grow local” strategy.

SFA offers a variety of support menus to assist agricultural businesses and food-related R&D. For example, SFA prepared an Agriculture Productivity Fund worth SGD 63 million (USD 47 million) to co-fund high-tech, productive farming systems with better environmental control, and to boost production capabilities and capacity1.

SFA, in collaboration with national research institute A*STAR, secured SGD 144 million of Singapore Food Story’s R&D Programme to support R&D in sustainable urban food production, future foods, and food safety science and innovation2.

On April 17, 2020, SFA announced the 30×30 Express grant to ramp up local production of eggs, vegetables and fish over the next six to 24 months in early stage of the Covid-19 pandemic2. SFA originally announced its budget as SGD 30 million in April, but this was increased it to close to SGD 40 million (USD 30 million) to subsidize nine companies on September 9.

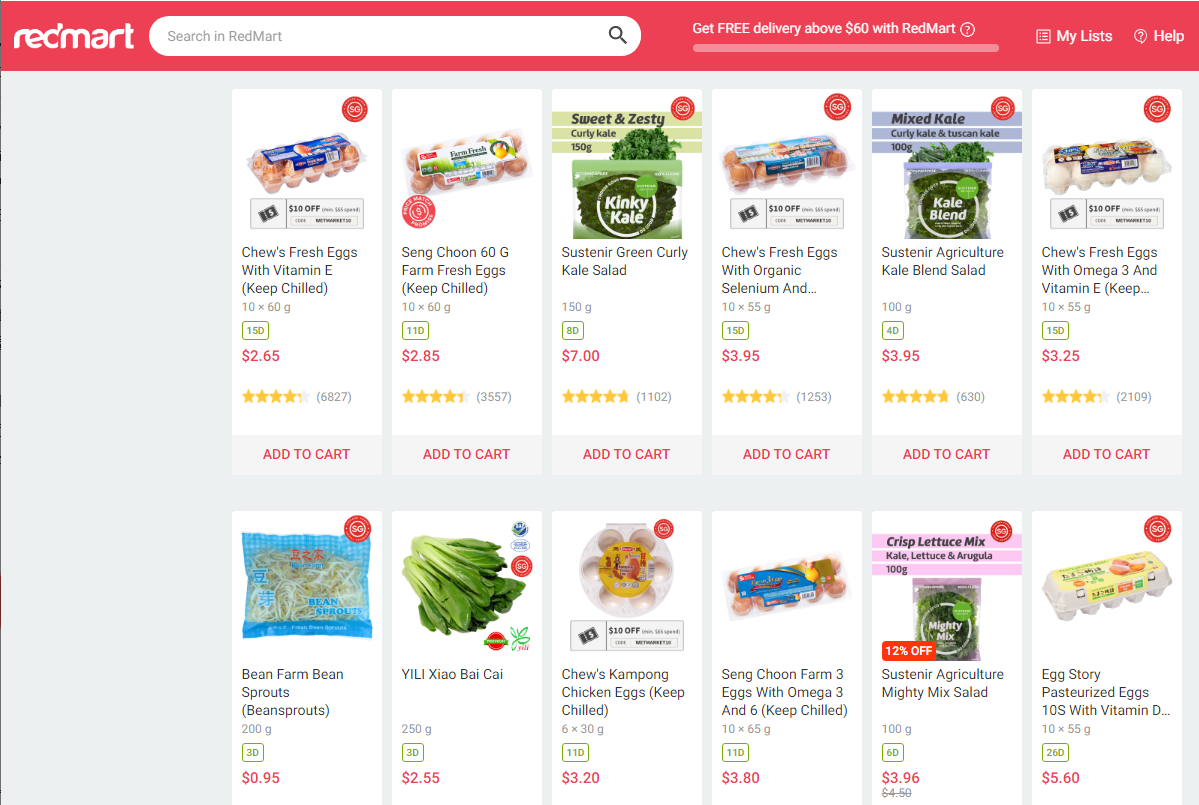

Singapore’s government also encourages citizen cooperation to achieve the 30 by 30 goal. One measure is the use of the SG Fresh Produce logo1. This logo can be found on agricultural products produced in Singapore. You can find these products in major grocery stores throughout the country2(Figure 3 and 4).

Figure 3 SG Fresh Produce logo

Figure 3 SG Fresh Produce logo

National Parks Board also provides useful information and hosts events for home gardeners and community gardeners4.

Many domestic and foreign food tech companies gather in Singapore and do business because Singapore’s government offers various types of policy measures related to food security. A few examples are listed below:

Eat Just, a startup from San Francisco has developed cultured chicken meat. In December 2020, SFA approved it as the world’s first meat not derived from slaughtered animals. Plant-based meat such as Beyond Meat, Impossible Foods and Quorn have been in the market as alternative meat sources, but this is the first time animal muscle cells have been cultured in a lab as meat to be eaten5.

Eat Just was founded in 2011. It is known that Hong Kong tycoon Li Ka-shing and Singapore state investor Temasek are backers of this company. Qatar’s sovereign wealth fund, the Qatar Investment Authority, and others invested in Eat Just in March 2021, raising USD 650 million in total. The company is valued at USD 1.2 billion.

Shiok Meats, a cell-based crustacean meat company in Singapore, raised USD 12.6 million from a Singaporean investment arm SEEDS Capital, a Japanese package manufacturer Toyo Seikan among others in October 2020. They will construct a pilot plant and start selling their products in 2022.

TurtleTree Labs has been developing cultured milk since 2019. This reduces CO2 emission by 98% compared to livestock farming. The milk produced is also of higher nutritional value. Temasek Foundation, a non-profit foundation owned by Singapore sovereign fund Temasek Holdings, injected SGD 1 million to TurtleTree Labs.

During his travels around Asia, Singaporean CEO Lin Fengru discovered an issue with livestock farming concerning hormones and antibiotics being pumped into cows. Max Rye, Chief Strategist, was a CEO in Silicon Valley and gave a session at Google on technology for making meat and seafood from cells. He met Lin Fengru, who was working at Google at that time, and discovered that there were no companies making milk from cell culture. They started research with scientists and filed patents3.

They raised USD 3.2 million in June 2020 and USD 6.2 million in December 20204. One of the company’s major investors is Prince Khaled bin Alwaleed bin Talal Al Saud, a vegan, and the son of a billionaire Al-Waleed bin Talal in Saudi Arabia.

There are urban farming companies from both Singapore and other countries receiving funding from the Singaporean government.

&ever, a German company focused on indoor vertical farming, announced in October 2020 their intention to set up a facility to produce 500 tons of vegetables a year in Singapore2. The company has received a 30×30 Express grant from SFA. &ever is also planning a R&D project with one of Singapore’s national research institute A*STAR, in collaboration with Signify, a lighting company. Research will focus on how to use sunlight and LED grow lights to minimize energy consumption and maximize production. The R&D center will also receive support from the Economic Development Board (EDB).

Singaporean company Sky Greens has operated the world’s first commercial vertical farm since 2012. The farm is 9-meters tall with 38 tiers, produces 500kg of vegetables every day and sells at grocery chain FairPrice Finest. Sky Greens’ vertical farm is covered by glass, and the tiers rotate so that sunlight hits evenly, which means that there is no need to use LED lights.

Singapore’s government created the world’s first standard for organic vegetables grown in urban farming, and certified Sky Greens in July 20192.

ComCrop was founded in 2013 and is currently the only commercial rooftop farm in Singapore. A hydroponic farm was built on the roof of a shopping center in Orchard, the largest shopping district in Singapore. It produces 150kg of vegetables and herbs a month2. ComCrop also created a 36,000 sq ft farm on the roof of a building for food companies built by JTC Corporation8, a government-owned industrial zone developer. They sell vegetables and herbs grown at major grocery stores such as RedMart and FairPrice. For example, caixin, a leafy vegetable common in Singapore, is produced by ComCrop and sold at S$3.90 per bunch at supermarkets. In the same supermarket, organic caixin from Malaysia is sold at $2.80 per bunch, which is about 1.4 times below the price of domestic, rooftop produced vegetables3.

ComCrop also received a 30×30 Express grant in September 202022.

Digital transformations are highly valued in Singapore. The government has historically facilitated innovation by intensely investing into specific industries such as biotech, fintech and smart city. Food tech and agri-tech became one of those industries in 2019. The Singaporean government welcomes foreign companies, and there are great business opportunities for startups with food tech or agri-tech technologies as well as large corporations and investors who are interested in those startups.

Following on are three types of business opportunities regarding food tech and agri-tech.

Food tech and agri-tech companies are strongly encouraged to expand their businesses to Singapore. There is funding and regulatory support from the Singaporean government, as well as the great potential of raising funds from investors.

There are also sizable opportunities for large corporations. Nowadays, companies are faced with the need to address their Environmental Social and Corporate Governance (ESG), and one way to do ESG business is to partner with food tech or agri-tech companies.

Singapore is an important city for investment firms that want to add food tech and agri-tech companies to their portfolio. The speed of growth is phenomenal, and no one should miss this chance.

We have recently been solicited by large Japanese companies wondering about how they can create new profitable businesses and achieve their ESG goals. One solution posed is to create a new business by partnering with a food tech or agri-tech startup.

IGPI has been supporting large corporations, SMEs and startups in the ASEAN region since 2013. We offer a wide range of business consulting services including consulting support on market entry, new business creation, and finding local partners. Our experiences include, but are not limited to:

If you have any questions or comments, please do not hesitate to contact us.

IGPI can provide strategy consulting for multiple aspects of your business in Singapore – Get in touch with our firm today!

Chieko Tazuke is an associate manager at IGPI Singapore. She joined IGPI Singapore in 2017 and has contributed to various projects including cross-border M&A by a Japanese company and PMI of its subsidiary overseas, organizational reform in a Japanese conglomerate, support for a Singapore startup to enter Japan market. She started her career at Ministry of Economy, Trade and Industry (METI), the government of Japan in 2011, and established four venture capital firms under top universities in Japan and injected more than a half billion dollars in the academic society. She holds an MBA from National University of Singapore, PhD in Neuroscience from the University of Tokyo, and Master of Design Methods from Illinois Institute of Technology.

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with presence and coverage across Asian markets. IGPI was established by former members of Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around funds supported by the Japanese government.

In 2017, IGPI collaborated with Japan Bank for International Cooperation (JBIC) to form JBIC IG, providing investment advisory services and supporting overseas investment. In 2019, JBIC along with BaltCap has jointly established Nordic Ninja, a €100 million venture capital fund to focus on deep tech sectors such as autonomous mobility, digital health, AR/VR/MR, artificial intelligence, robotics and IoT in the Nordic and Baltic region. In 2019, IGPI established IGPI Technology to focus in the area of science and technology. The company invests in technological ventures and provides hands-on management support. The company also provides business development support towards commercialization and monetization of technologies.

Chieko Tazuke

Associate Manager

+65 90234885

c.tazuke@igpi.co.jp

This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.

1 Singapore Food Authority

2 The Straits Times

3 RedMart

4 National Parks Board

5 Reuters

6 Channels News Asia

7 PR Newswire

8 JTC Corporation