The "Carbon Neutral Declaration" aiming for a society with zero CO2 emissions by 2050 was made by the Japanese government in October 2020. Since then, Japanese companies have been accelerating their efforts to set long-term goals aimed at decarbonizing their operations. IPCC’s Sixth Assessment Report published in August 2021 declared that human influence has unequivocally warmed the atmosphere. Human-induced climate change is already affecting weather and climate extremely in every region across the globe, which had further stirred up the world's sense of crisis.

However, with or without the government pressure, Japanese companies operating overseas had already been under strong pressure to decarbonize from NGOs, institutional investors, lenders, insurance companies and customers for several years, and been trying to tackle this issue and survive. This is true of companies in Southeast Asian countries as well. Some countries and companies have recently set ambitious long-term goals based on the Paris Agreement. The following points will be discussed in this article:

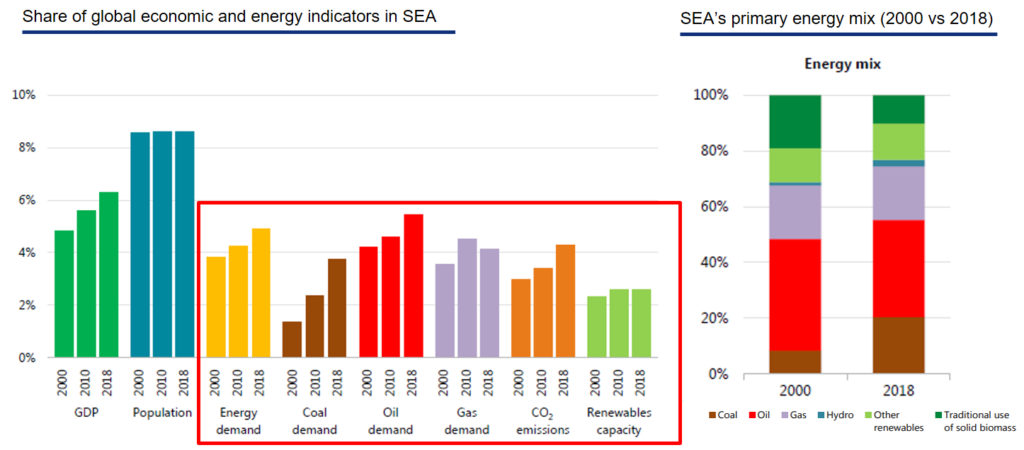

Southeast Asia’s economic and energy presence in the globe is growing. This region is one of the fastest growing drivers of energy demand in the world. Looking back in time, it can be seen that coal and oil have satisfied the energy needs of Southeast Asian countries. [1]

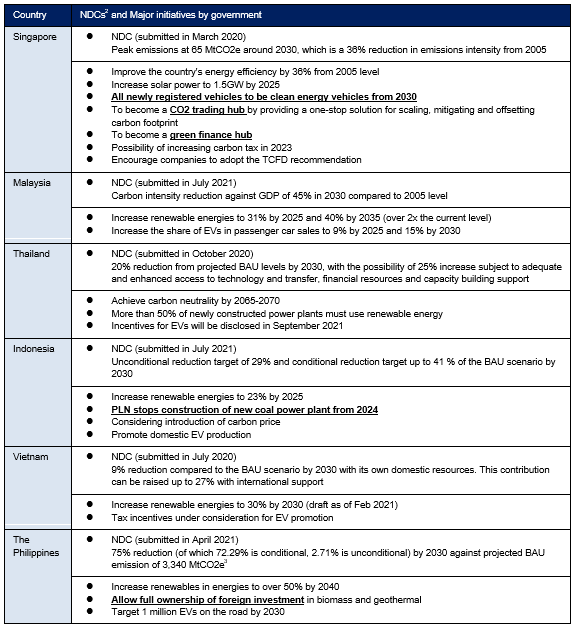

However, in accordance with Paris Agreement, six major ASEAN countries are also setting their targets to reduce greenhouse gases (hereinafter “GHG”) by replacing fossil fuels with renewable energies. Nonetheless, when examining their National Determined Contributions (hereinafter “NDCs”), it is necessary to bear in mind that most countries propose two frameworks towards achieving their target, one includes financial assistance from the international community, and the other without[4]. This means that foreign companies who wish to do business related to carbon reduction need proposals tied to the financial support framework. In addition, many countries adopt future targets compared against a business-as-usual (hereinafter “BAU”) levels, meaning they pledge to reduce CO2 emissions compared to their projection in the absence of major climate change policies. Additionally, Malaysia adopts their reduction target on carbon intensity against GDP basis. The table here-below lists the NDCs and major initiatives by governments in Southeast Asia:

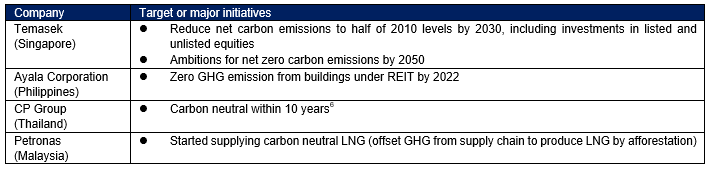

Many companies in Southeast Asia as well as Japan have started to declare net carbon ambitions. However, it is necessary to bear in mind that different companies will often use different standards and refer to different scopes. Many companies are still struggling to capture their Scope 3 emissions. Scope 3 refers to carbon emissions that occur indirectly in a company’s value chain. This is an area that is difficult to reduce because it requires cooperation from suppliers, and sometimes drastic changes in the value chain. The larger the company with influence over the supply chain, the more significant it is to address it.

The same is true for investors, who have influence over their investments. For example, Temasek incorporates ESG considerations into their investment decision-making and management.[5] In terms of tackling climate changes, Temasek has committed to reducing the net carbon emissions to half the 2010 levels by 2030. They have signaled their ambitions for net zero carbon emissions by 2050, extending to their equities portfolio. Temasek also adopts an internal carbon price of US$42 per tCO2e to inform their investment decisions. The table below shows examples of initiatives by companies in Southeast Asia to combat climate changes.

With the momentum for de-carbonization in Southeast Asia as a backdrop, apart from renewables and its associated technologies, there are already new businesses focusing on scaling of GHG, trading them, and making platforms.

For example, in May 2021, it was reported that a new global carbon exchange will be launched in Singapore within the year. Companies unable to reduce emissions can purchase a carbon credits through this platform. It will be interesting to see how much the platform will be utilized internationally.

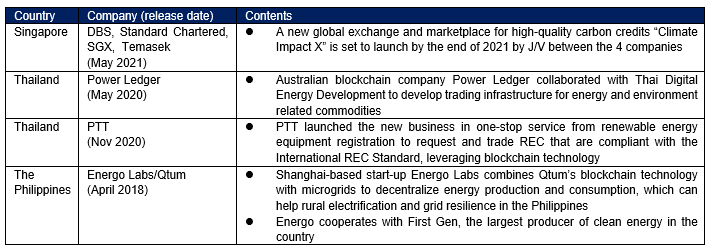

In other countries such as Thailand, businesses related to the Renewable Energy Certificate (REC) trading market are flourishing, as are startups offering blockchain technology. Please refer to the table below for examples of companies engaging in scaling, trading, and making platforms in the region:

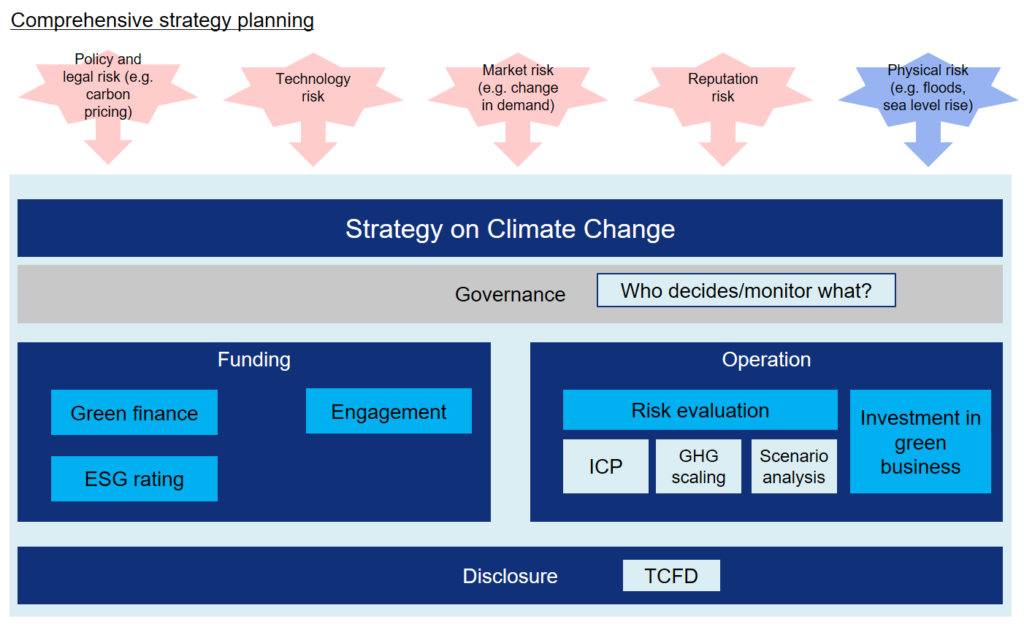

Following are a few points regarding strategy planning amid a carbon neutral era. As shown in the image below, there are many factors to be incorporated in corporate activities starting from governance to disclosure, which means that comprehensive strategy planning is inevitable. There are two types of risks that companies need to be aware of: physical risk and transition risk. Transition risk refers to the risk posed by changes in, for example, climate change policies and regulations, technological developments, market trends, and market assessments. In other words, it is necessary to follow the policies of each country and act in advance so as not to fall behind.

In addition to hedging against these risks, there is also the possibility of seizing new business opportunities and the need for a major change in policy from traditional businesses. While financial institutions have withdrawn from fossil fuel-based businesses, options such as green finance have emerged. It is necessary to consider both risks and opportunities when formulating strategies for the existing companies or future businesses.

The above paragraphs served as a general discussion. Internal carbon price (hereinafter “ICP”) will be used as an example to explain factors that need to be taken into consideration.

Businesses use ICP to evaluate the impact of mandatory carbon prices on their operations, and as a tool to identify potential climate risks and revenue opportunities[7]. ICP was introduced in Europe and the US over five years ago, and an increasing number of Japanese companies have adopted it in the past few years.

When introducing ICP, the most important thing to keep in mind is to set a clear objective and design business strategies accordingly[8]. If objectives are not properly set, the business will end up on the Carbon Disclosure Project (CDP) list as “ICP introduced” but it is meaningless to be satisfied with this. It is easy but it is meaningless to only refer to competitor’s pricing. If companies want to invest in expensive but low-carbon equipment, compared to conventional equipment, in their factories or offices, the price must be at a level that makes low-carbon equipment more economically advantageous.

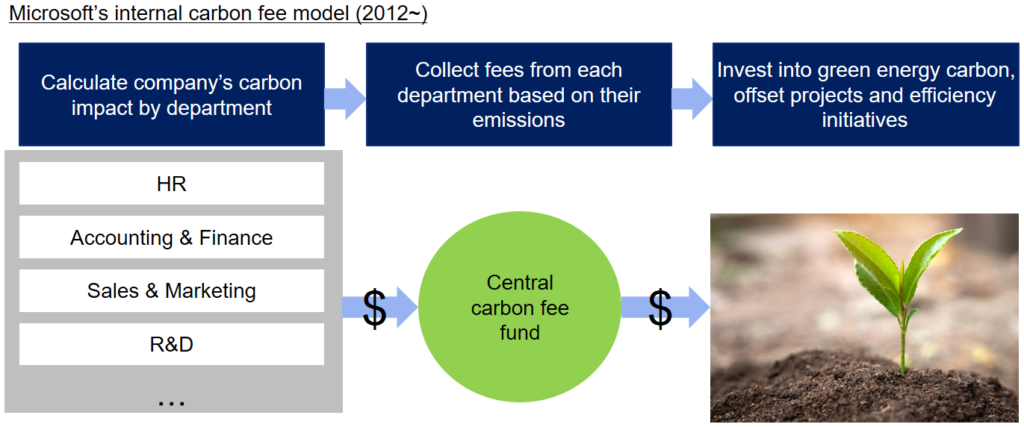

As an oft-cited example, Microsoft has adopted a model in which each department pays an amount based on its CO2 emissions, whose price is determined by dividing necessary investment amounts to offset annual CO2 emissions[9]. This pricing mechanism is reasonable. CO2 emissions are also reflected negatively in Microsoft’s sales departments’ internal profit and loss statements, which incentivizes carbon reduction efforts.

In the case of business investments, it is one way to refer to price levels that may have influenced investment decisions in the past (this is a pattern called “implicit carbon price”), not only referring to market price of carbon. Many companies adopt a market price such as the EU ETS (EU Emissions Trading System). While this makes a certain amount of sense from the perspective of scenario analysis, there is no guarantee that the carbon pricing imposed in different countries in future will be close to the current EU ETS price.

Moreover, ICP is not a solution for everything. Even if a project pays off economically under a scenario where ICP is applied. There remains the possibility that the project may be forced into cancellation due to opposition from activists or institutional investors. While ICP can be useful if introduced wisely, it is not a panacea, but a tool in the overall strategy for businesses looking to reduce their carbon footprint.

As stated above, climate change issues as well as other ESG-related issues require a comprehensive approach towards governance, funding, operations, and the creation of new businesses.

IGPI’s Singapore office was established in 2013. Since then, our consulting services have supported many Japanese companies with business planning, new business creation, finding partners as well as market entry research.

To find out more about how IGPI can provide Japanese consulting support for business in Singapore and the region, browse through our insight articles or get in contact with us.

Having worked for Sumitomo Corporation for 12 and a half years, one of the major general trading firms in Japan, Miyoshi Nishimura has rich experience in risk management and industry & strategic research areas. She was engaged in multiple M&A deals including on-site D.D. aboard, valuation, negotiations and collaboration with internal/external counterparties. As leading Strategic Research Team at Sumitomo Corporation Global Research, Miyoshi researched and analyzed new business areas and reported to the managements. She graduated from Law faculty of Chuo University.

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business consulting firm with presence and coverage across Asian markets. IGPI was established by former members of Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a US $100 billion Japanese sovereign wealth fund, is known as one of the most successful turn-around fund supported by the Japanese government.

In 2017, IGPI collaborated with Japan Bank for International Cooperation (JBIC) to form JBIC IG, providing investment advisory services and supporting overseas investment. In 2019, JBIC along with BaltCap has jointly established Nordic Ninja, a €100 million venture capital fund to focus on deep tech sectors such as autonomous mobility, digital health, AR/VR/MR, artificial intelligence, robotics and IoT in the Nordic and Baltic region. In 2019, IGPI established IGPI Technology to focus in the area of science and technology. The company invests in technological ventures and provides hands-on management support. The company also provides business development support towards commercialization and monetization of technologies.

IGPI Australia is a branch office of IGPI Singapore. The later which was established in 2013 focus on management consulting and M&A advisory in Southeast Asia across various sectors. We act as a bridge between Japan and wider APAC, having advised on market entry strategy, potential target search, valuation, due diligence, M&A process management, post-merger integration and change management for leading Japanese clients. In addition, we have helped businesses in Southeast Asia enter Japan and acted as sell-side advisor for SMEs and private equity fund looking to divest. IGPI Australia was established in 2020 with a dual focus of helping Australian businesses enter and grow in ASEAN / Japan and attracting Japanese investments into Australia. We have since successfully help to connect multiple Australian businesses with Japanese businesses within IGPI’s network.

Get in touch with us on internationalization, strategic planning and fund-raising related topics!

This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.

[1] https://iea.blob.core.windows.net/assets/47552310-d697-498c-b112-d987f36abf34/Southeast_Asia_Energy_Outlook_2019.pdf

[2] https://www4.unfccc.int/sites/NDCStaging/Pages/All.aspx

[3] https://www.greengrowthknowledge.org/sites/default/files/downloads/policy-database/Philippines%20-%20NDC.pdf

[4] Although not discussed in detail in this report, there has been ongoing debate for many years on the framework for financial assistance from developed countries to developing countries on climate change. This means that there are unknown factors in the GHG reduction targets of developing countries.

[5] https://www.temasek.com.sg/en/sustainability/focusing-on-climate-change#metrics-targets

[6] The company also stated to set the carbon neutral goal throughout the entirety of its supply chain but it is not clear the timeframe is the same. (https://www.bangkokpost.com/thailand/general/2137519/cp-takes-on-climate-change-vows-to-be-carbon-neutral)

[7] https://carbonpricingdashboard.worldbank.org/what-carbon-pricing

[8] “Executive Guide to Carbon Pricing Leadership: A Caring for Climate Report” by United Nations, etc. is useful material (https://www.unglobalcompact.org/library/3711)

[9] https://download.microsoft.com/documents/enus/csr/environment/microsoft_carbon_fee_guide.pdf