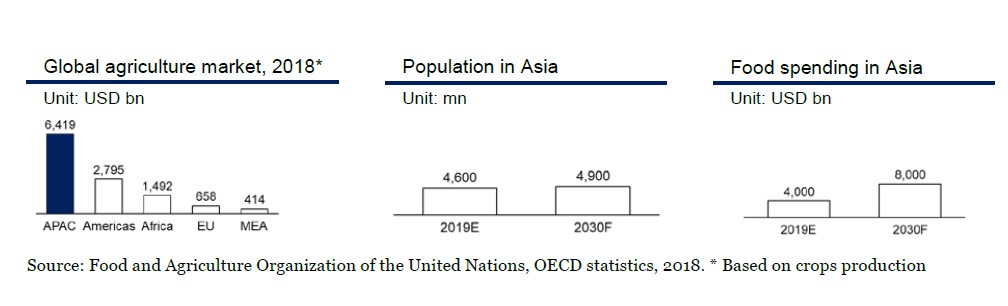

Asia Pacific is the largest region in the agriculture market by far, accounting for USD 6,419 bn or 54.5% of global market share in 2018. It is expected to continue growing over the long term as populations and consumption demand increase both in Asia and globally.

However, along with weather risks and climate change, Asia Pacific’s agriculture industry faces supply side challenges due to labour (related to ageing farmers, increased urbanization), reduced access to capital and natural resources and fragmented supply chain leading to food wastage. Urgent actions and shared responsibility are required to face these challenges but it also provides significant opportunities for innovation and disruption for the industry.

As the demand for increased productivity rises, the agriculture sector is looking into adopting technologies (i.e. agriculture technology or “AgriTech”) that improve yield, efficiency, and profitability. These technologies have already started to help farmers in the region including the following:

• Information and data analytics: farmers and producers are able to plan their production according to accurate data patterns;

• IoT and automation: technologies that help in automation of farming processes (such as monitoring the crop field with the help of sensors (light, humidity, temperature, soil moisture, etc.) and automating the irrigation system);

• Marketplace platforms: platforms that aid in connecting small scale farmers with larger consumer markets; and

• Agronomy and agricultural biotechnology: innovate inputs for crop and animal agriculture (such as seeds, pest control, seeds with new genetics) with the use of scientific tools and techniques.

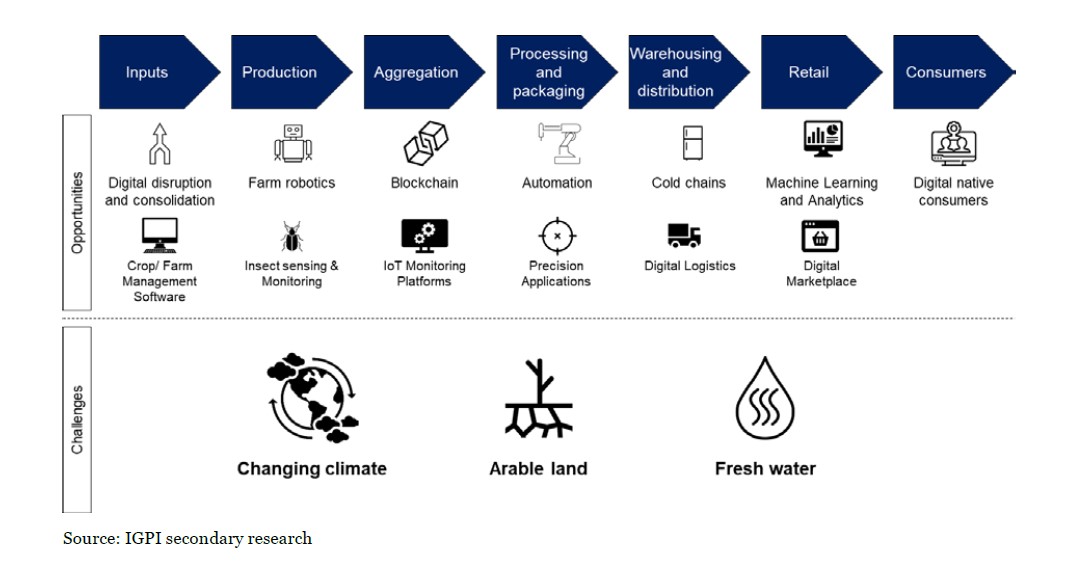

There are many technological opportunities throughout the value chain as illustrated in the below chart:

Though businesses are resuming slowly in Asia Pacific, the coronavirus pandemic and resulting lockdown restrictions are inevitably still impacting most industries in the region and globally, including agriculture. Global supply chains are disrupted, labour availability is further limited and market access is restricted due to issues in transportation and operation temporary shutdowns.

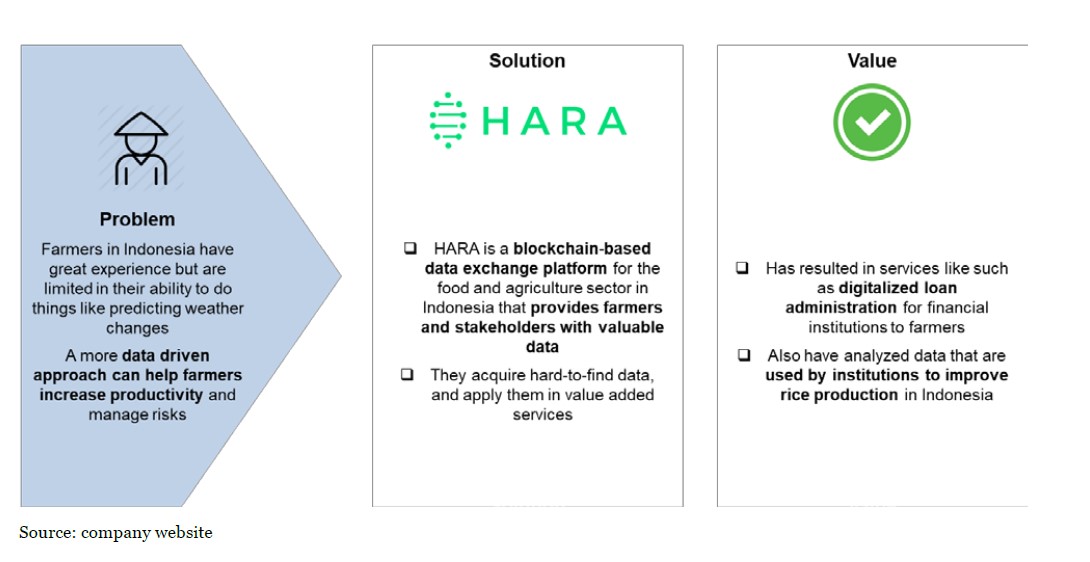

However, Covid-19 represents a unique opportunity for AgriTech startups to highlight how the adoption of technology and innovation in agriculture can solve the problem of not only yield, but procurement and speed up the entire agriculture supply chain. As an example in Indonesia, farmers have great experience but are limited in their ability to predict weather changes. As such, a more data driven approach can help farmers increase productivity and manage risks. HARA, a blockchain-based data exchange platform for the food and agriculture sector in Indonesia, provides farmers and stakeholders with hard-to-find data to improve their production. This data has also been beneficial for several financial institutions to make data-driven decisions by digitizing loan administration and disbursement process.

Example of AgriTech in Indonesia, HARA:

AgriTech is also a driving force behind acquisitions as agricultural companies are looking to expand their technical capabilities. For example, Japanese conglomerates are acquiring startups and investing in companies that have promising new technology in order to provide further growth outside their domestic market.

In February 2020, Sojitz Corporation, a listed Japan based conglomerate that operates in various sectors including agriculture, acquired RYNAN Holdings Joint Stock Company, a digital farming platform startup in Vietnam. With the development of software for IoT and AI services, the startup is able to help farmers improve productivity by offering an app-based system for procuring agricultural supplies, as well as for monitoring crop cultivation and managing water systems. Sojitz is looking to utilize its existing network both in Vietnam and overseas to expand the farming platform’s business with this investment in RYNAN.

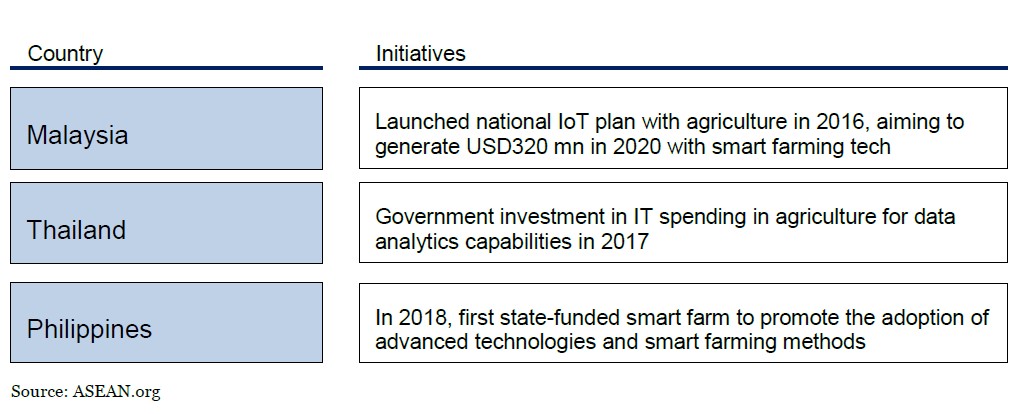

Furthermore, in order to keep pace with demand, governments have been supporting the adoption of technologies in agriculture to improve productivity of agriculture. They have implemented various technology schemes over the last few years to help their domestic agriculture producers become more efficient through adoption of relevant technologies.

Examples of government initiatives are as follows:

Leveraging from its deep experience in the agriculture sector, IGPI has recently conducted a research with analysis of various case studies to understand the current landscape of the agriculture industry: “Trends and opportunities in the Agriculture sector in ASEAN.” IGPI has access to local businesses in the ASEAN region that are adopting technologies, providing significant opportunities to expand their business domestically or within the region.

We would be happy to share our key findings in this sector, share investment opportunities or assist you to find the best partners for your business to grow.

Please contact us to receive the full report

About the Authors

Kim-Lân Dang is a Senior Manager at IGPI Singapore. Started his career in 2008 with PricewaterhouseCoopers Luxembourg and Ernst & Young Singapore. Before joining IGPI, he worked at BDA Partners and TC Capital in Singapore. Kim-Lân has vast experience in advising blue-chip private equity funds, entrepreneurs, and corporates on divestments and capital raises. He has executed transactions across Southeast Asia including consumer/retail, IT, telecommunications, financial services, and financial technologies.

Yvonne Lim is an Associate at IGPI Singapore. She has varied experiences working with large Japanese companies and multinationals across various industries. During her sabbatical year in her consulting career, she headed operations for a Singaporean travel tech startup in Japan. She started her career as a management consultant in Japan, specializing in technology consulting and project management.

About IGPI Singapore

Industrial Growth Platform Inc. (IGPI) is a premier Japanese business advisory firm with presence and coverage across Asian markets. IGPI was established by former members of Industrial Revitalization Corporation of Japan (IRCJ) in 2007. IRCJ, a USD 100 bn Japanese sovereign wealth fund, is known as one of the most successful turn-around fund supported by the Japanese government.

In 2017, IGPI collaborated with Japan Bank for International Cooperation (JBIC) to form JBIC IG, providing investment advisory services and supporting overseas investment. In 2019, JBIC along with BaltCap has jointly established Nordic Ninja, a EUR 100 mn venture capital fund to focus on deep tech sectors such as autonomous mobility, digital health, AR/VR/MR, artificial intelligence, robotics and IoT in the Nordic and Baltic region. In 2019, IGPI established IGPI Technology to focus in the area of science and technology. The company invests in technological ventures and provides hands-on management support. The company also provides business development support towards commercialization and monetization of technologies.

IGPI Singapore was established in 2013 to focus on management consulting and M&A advisory in Southeast Asia across various sectors. We act as a bridge between Japan and Southeast Asia, having advised on market entry strategy, potential target search, valuation, due diligence, M&A process management, post-merger integration and change management for leading Japanese clients. In addition, we have helped businesses in Southeast Asia enter Japan and acted as sell-side advisor for SMEs and private equity fund looking to divest.

Get in touch with us on strategic planning, market assessment and M&A related topics!

IGPI Singapore – contacts:

This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as a digital transformation advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.