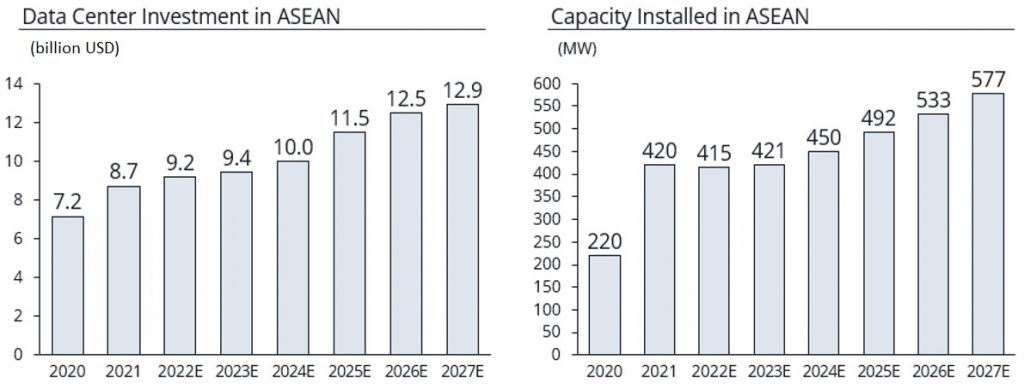

The Southeast Asia data center market is one of the fastest-growing globally, driven by several key factors. The adoption of cloud-based services is expected to be a major growth driver in the coming years. Additionally, Singapore is set to become the first country in the region to implement 5G technology, with Thailand, Malaysia, and Vietnam also planning and investing in 5G network deployment in the next 5 years. This will further increase data generation, necessitating data centers to manage more complex network traffic. Moreover, the growing demand for generative AI, which requires substantial computational power and vast amounts of data storage, is expected to further drive the need for data center resources.

Graph1. Data Center Market Forecast in ASEAN[1]

The maturity of the data center market in ASEAN countries is as follows:

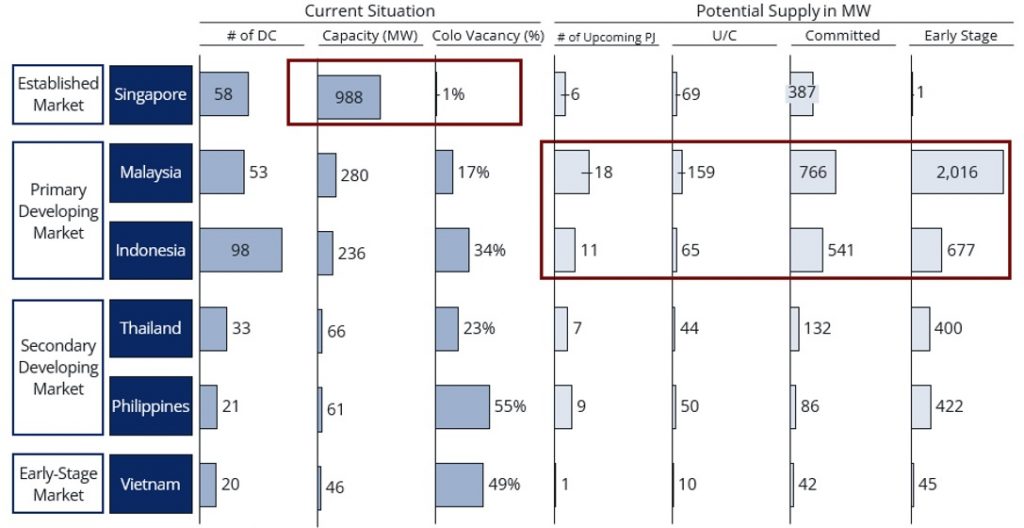

Table1. Number of Data Centers with Capacity and The Breakdown of Upcoming Projects by Stage[2]

Singapore is the most mature market in the region. In the APAC area, it ranks second only to Tokyo, with 1GW of operational capacity and a remarkably low vacancy rate of just 1%. In 2019, concerned about the increase in power consumption and the environmental impact caused by the rapid surge in data centers, the Singapore government imposed a moratorium on new data center construction. However, this moratorium was lifted in 2022, and in May 2024, the government announced the “Green Data Center (DC) Roadmap,” which includes goals such as providing at least an additional 300 megawatts (MW) of capacity in the near future and expanding capacity further through the adoption of green energy.

Indonesia and Malaysia are fast-growing markets with enormous supply potential, further driving data center growth in ASEAN. In Malaysia, data center investments are rapidly increasing, particularly in Kuala Lumpur and Johor, while in Indonesia, Jakarta is seeing a surge in investments. This growth is driven by the expansion of the digital economy, the rise of cloud adoption, and hyperscalers such as GAFAM and major Chinese tech players investing in the region. In Malaysia, the government is also working on implementing a regulatory framework focused on sustainability.

Most of the new data centers to be built in the near future will be hyperscale facilities. For instance, out of 18 upcoming projects in Malaysia, 11 are designed as hyperscale, similar to 6 out of 11 in Indonesia and all 9 upcoming projects in the Philippines. This trend towards larger, higher-performance data centers is fueled by advancements in AI technologies.

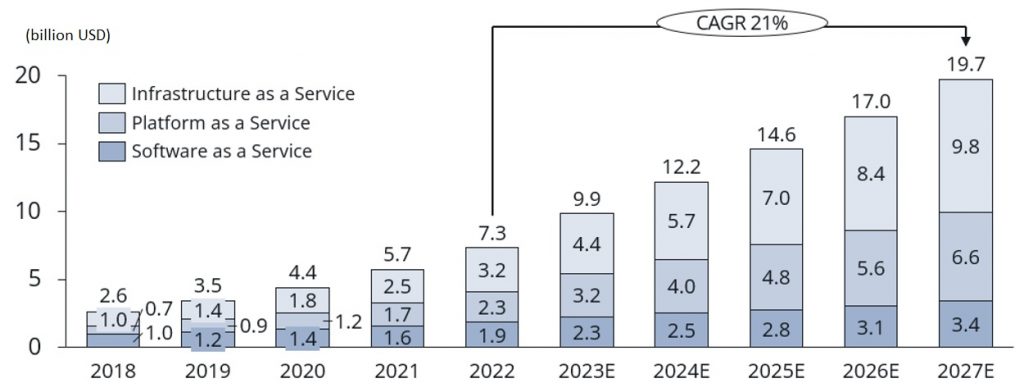

The increasing use of cloud computing in both the public and private sectors in Southeast Asia is a key factor driving the demand for data centers.

For example, the Singapore government set a target to migrate most of its less sensitive digital workloads to the commercial cloud by 2023 and successfully achieved it. Similarly, many large companies in Singapore’s private sector have begun adopting cloud services, utilizing these solutions to implement advanced technologies such as artificial intelligence and machine learning.

In 2021, the Malaysian government introduced a cloud-first strategy in the public sector to increase cloud adoption rates to 50% by 2024.

Meanwhile, Indonesia’s cloud computing market has experienced remarkable growth, with a CAGR of 48%, over the last 5 years, according to CNBC Cloud. This surpasses the global average, and currently, 90% of companies in Indonesia are moving towards cloud computing solutions.

Amid these trends, the cloud market in ASEAN is expected to grow at a 21% CAGR.

Graph2. Public Cloud Market Revenue in ASEAN by Segment[3]

Additionally, to meet the growing demand for data storage and processing, major cloud providers are expanding into the ASEAN region. For example, in 2024, Microsoft announced several significant investments. In April, the company committed $1.7 billion to build new cloud and AI infrastructure in Indonesia over the next four years. In May, Microsoft pledged $2.2 billion to further develop digital infrastructure in Malaysia and also announced its first regional data center, focused on providing AI training opportunities, although the investment amount was not disclosed.

Table2. Area Coverage of Major Cloud Provider in ASEAN[4]

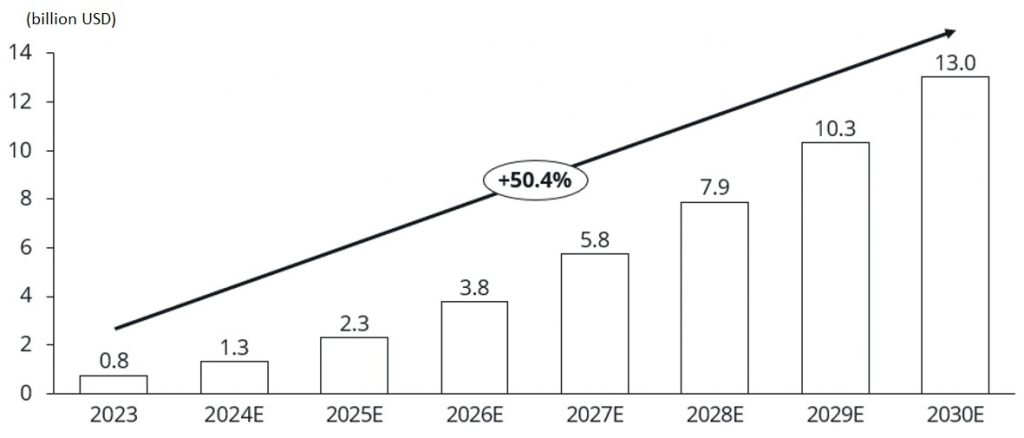

The generative AI market is growing rapidly in Southeast Asia. Currently valued at $0.8 billion, it is expected to reach $13 billion with a 50% CAGR by 2030.

Graph3. Generative AI Revenue Forecast (ASEAN) as of Mar 2024[5]

Indonesia, ranked sixth globally for its number of startups, is experiencing significant growth in generative AI applications, such as chatbots. One example is Kata.ai, which focuses on natural language processing to provide AI-powered conversational chatbots, helping businesses engage with customers more effectively. Kata.ai has a proven track record with major telecommunications companies and state-owned banks. Mekari, a leading SaaS company, also entered the generative AI business in 2023, offering tailored advice on management strategies by analyzing clients’ financial and HR data.

Advances in generative AI are driving increased demand for new types of data centers. Generative AI models, particularly large-scale language models (LLMs) and image generation models, require immense computational resources for both training and inference. This necessitates specialized hardware, including large numbers of GPUs and TPUs (Tensor Processing Units), which are more expensive than conventional CPU-based systems. These specialized systems also require more power and cooling, and take up more physical space, fueling demand for higher-performance and larger data centers, such as hyperscale data centers. Over the next 6 years, the average data center capacity is expected to double, while total capacity is projected to triple.

As generative AI technologies become more widespread, the computational load will increase, leading to higher power consumption. To illustrate, generating a response from ChatGPT requires roughly ten times the energy of a traditional Google search. Based on 9 billion searches per day, this translates to an additional 10 terawatt-hours of energy consumed annually (according to a report by the International Energy Agency, IEA). Furthermore, as computational loads increase, so does the heat generated by servers, which in turn drives up the energy needed for cooling. It’s estimated that cooling accounts for about 30-40% of a data center’s total energy consumption. Overall, the IEA has announced that the power consumption of data centers could double by 2026 compared to 2024 levels.

As power consumption in data centers increases due to the use of generative AI and other technologies, several challenges arise. These include whether we can meet the new energy demands, what types of energy will be used to supply this demand, and how these needs can be balanced with decarbonization goals. However, these challenges present new business opportunities for those who can provide solutions.

[Increasing Energy Efficiency in Data Centers]

One approach is offering hardware and software services aimed at reducing power consumption and improving the efficiency of data centers. For example, the Singaporean startup KoolLogix provides thermal management solutions for data centers. KoolLogix reduces the power consumption of data centers by implementing an innovative cooling system that addresses the inefficiencies of traditional cooling methods. Their system focuses on removing the waste heat generated by servers using a passive heat exchange and phase change approach. Instead of relying on energy-intensive air conditioners, the KoolLogix system uses the servers’ waste heat to power a refrigerant-based cooling loop. This system operates without mechanical pumps or compressors, relying on natural convection, which significantly lowers energy consumption.

[Providing Green Energy to Data Centers]

Another approach is building infrastructure to supply clean energy to data centers. This could include constructing power plants that utilize renewable energy sources such as solar, wind, hydro, or geothermal power. These plants would then supply clean electricity to data centers through long-term contracts. In this model, power generation companies sign Power Purchase Agreements (PPA) with data center operators to provide predictable, long-term energy at stable prices.

One example is an initiative launched in Japan in April 2024. Green Power Investment Corporation (GPI) and Kyocera Communication Systems Co., Ltd. (KCCS) are collaborating on a local renewable energy production and consumption model aimed at supplying a zero-emission data center with clean energy. Specifically, GPI’s subsidiary, Green Power Retailing LLC (GPR), will procure electricity generated by the Ishikari Bay New Port Offshore Wind Farm through a specified wholesale supply of renewable energy. This power, along with FIT non-fossil certificates with tracking from the Ishikari Bay wind farm, will be supplied to KCCS’s Zero Emission Data Center (ZED), which is scheduled to open in autumn 2024 in Ishikari City, Hokkaido, and will be operated entirely on renewable energy.

Since its establishment in 2013, IGPI Singapore has supported many Japanese companies with market research, strategy planning, and execution support, including partner search and approach, ideation, and related training for new business creation in Southeast Asia.

Leveraging the extensive insights gained through involvement in the management of data center-related companies in Japan, along with its strong network of data center players in the ASEAN region, IGPI Singapore is well-positioned to offer consulting services. These services include market entry strategies and the development of partnerships with local players in the data center industry. Through on-the-ground research conducted by local staff in ASEAN, IGPI Singapore stays informed about real-time trends in the region’s data center market. This knowledge allows IGPI Singapore to craft effective market strategies and identify potential partners.

To find out more about how IGPI can provide consulting support for businesses, browse through our insight articles or get in contact with us.

[1] Arizton

[2] Data Center Map, DC Byte (Apr 2024), Cushman & Wakefield (Apr 2024)

[3] Statista

[4] IGPI Research. As per public disclosure, Mar 2024

[5] Statista

Mr. Jongwoo Lee is the Manager of IGPI Singapore. He worked for a Japanese general IT consulting firm, where he was involved in numerous projects such as business planning and implementation support, new business planning, operational efficiency improvement, and business management enhancement support in a wide range of industries, including trading companies, energy, manufacturers, automobiles, and systems, etc. After joining IGPI, he has extensive experience in new business creation in Southeast Asia, including the development of new business models and strategies for expanding sales of new solutions in the Southeast Asian market and the study of new business entries for local companies in Southeast Asia. Graduated from the University of Tokyo, Faculty of Economics. Japanese Certified Public Accountant

Industrial Growth Platform Inc. (IGPI) is a Japan-rooted premium management consulting & investment firm headquartered in Tokyo with offices in Osaka, Singapore, Hanoi, Shanghai & Melbourne. IGPI was established in 2007 by former members of Industrial Revitalization Corporation of Japan (IRCJ), a USD 100 billion sovereign wealth fund focusing on turnaround projects in Japan. IGPI has 13 institutional investors, including Nomura Holdings, SMBC, KDDI, Recruit & Sumitomo Corporation, to name a few. IGPI has vast experience supporting Fortune 500s, government. agencies, universities, SMEs, and funded startups across Asia and beyond for their strategic business needs and hands-on support across a wide variety of industries. IGPI group has approximately 7,500 employees on a consolidated basis.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.