In this article, we highlight why it is imperative for CPG companies of all sizes across the value chain, now more than ever, to develop or refine their rationalisation framework in their product management toolbox, share key success factors in crafting a rationalisation strategy and shed light on common pitfalls.

In 2021, facing rising input cost inflation and squeezed margins, Nestlé S.A. kicked-off Project TASTY as part of a wider value creation strategy, focusing on achieving cost savings, margin improvements and long-term growth via SKU rationalisation and recipe and packaging optimisation.

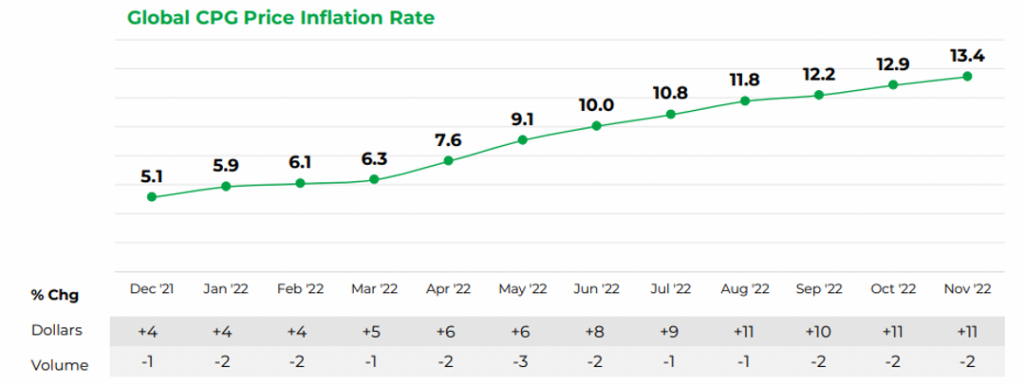

Table 1: NIQ 2023 Consumer Outlook Report – Global CPG Price Inflation Rate

One year on, CPG companies across the value chain faced persistent inflation, driving prices higher and negatively impacting sales volumes across categories. The pandemic also accelerated digital transformation across the entire value chain, with CPG companies of all sizes finding themselves at varying stages of implementing and leveraging newfound digital infrastructure, data pools and analytical capabilities. Changing consumer preferences stemming from rising prices and the pandemic include a rising preference for online shopping, variations in purchase frequency and a flight towards value, albeit varying across the different product categories.

Such shifts warrant a reprioritization of multi-dimensional criteria in assessing an SKU’s historical financial and operational performance and strategic importance in the short and long-term. At a time of internal change and external shifts, CPG companies have been presented with a golden opportunity to revisit their product mix management strategy, spanning both SKU innovation and rationalisation.

Performing a one-off innovation or rationalisation exercise will not suffice – corporations should capitalise by fundamentally redesigning their product mix management frameworks, leveraging new consumer touchpoints, access to big data and advanced analytics while revisiting and updating previous methodologies and key performance indicators (KPIs). In lieu of current cost-side pressures, SKU rationalisation remains a priority and a valuable first step in the SKU optimisation cycle.

Category managers and executives have long understood the need to consider the importance of considering multiple performance dimensions in addition to SKU-level financials and embracing product basket synergies, overall mix value contribution and long-term growth potential.

In developing or refining existing frameworks, much emphasis is placed on analytical capabilities, data collection and execution agility. However, CPG companies today should also consider strategic elements that have significant bearing on the value unlocked from a rationalisation exercise, such as the following:

The push for digital transformation entails new infrastructure, workflows and data collection and analysis capabilities. In the midst of change, companies that capitalise on this opportunity to amalgamate existing SKU rationalisation workflows and data needs with new systems will be able to minimise resources spent on data interpretation and developing actionable insights.

In migrating to new systems, optimization from the collection of data through to the visualisation and framing of key indicators is imperative and companies must actively drive the development of integrated workflows from the get-go. Executives and managers should also re-evaluate existing digital infrastructure and contrast this against rationalisation needs and the price and value of current market offerings.

In the pursuit of data-driven insights on SKU performance, companies must also recognise the value of consolidating, interpreting and transforming qualitative inputs from within the organisation (and in some instances, select third-parties involved in distribution, retail or day-to-day operations) into actionable items. More often than not, following rigorous quantitative analysis, qualitative assessments are performed at the executive level or within the steering committee as a final ‘check’ just before implementation to ensure alignment with leadership’s understanding. In doing so, a wealth of insights from the ground remain untapped and deep understanding of select categories or products are not fully leveraged.

To capitalise, companies must embark on a path of systemizing qualitative inputs, designing existing SKU rationalisation frameworks to periodically collect, consolidate and transform feedback from the ground into actionable items.

Forming the basis of a periodic rationalisation exercise is a set of clearly quantitative targets spanning different performance dimensions, such as a minimum improvement in gross margins or process cycle efficiency. Leveraging stronger analytical capabilities and big data, companies can supplement such targets with sensitivity analyses comprising multiple iterations and combinations to obtain a clearer picture of:

(1) The array of possible rationalisation solutions to achieve current targets

(2) The extent of marginal improvements by extending the number of SKUs reduced in different scenarios

In doing so, companies shift from a target-focused mentality to one of value-maximisation, driving larger value gains in the long run. The steering committee and key decision makers should also note the interests of other stakeholders and evaluate the pros and cons of adopting a rationalisation strategy based on the company’s ultimate priorities.

IGPI Singapore worked with a beverage distributor undergoing a major system migration to analyse their existing SKU portfolio and recommend candidates for rationalisation, which would improve:

● Financial metrics by driving gross margins

● Operational metrics by improving warehouse inventory turnover

● Strategic metrics by aligning the SKU mix with the firm’s strategic direction

We designed a framework detailing each step of our approach to the rationalisation, beginning with segmenting SKUs into analysis groups based on key criteria. We proceeded to develop and refine the KPI that determined each SKU’s performance. Next, we performed multi-dimensional analysis supplemented with sensitivity analyses for each KPI to identify potential candidate SKUs, while managing data coherence across legacy and new systems. Finally, we incorporated qualitative insights drawn from departments within the company and industrial best practices to develop our final rationalisation recommendations.

Recognizing the importance of implementing a sustainable solution for our client rather than a one-off exercise, we developed a tailor-made rationalisation tool custom-fitted for the new system to allow managers to replicate our work steps, perform the rationalisation exercise and quantify the impact on KPIs independently going forward.

The rationalisation led to a significant reduction in the number of SKUs, projected growth in gross margins and improved operational workflows.

High-level company-wide strategic direction and goals underpin a rationalisation exercise, forming the basis of rationalisation targets and facilitating compromise across KPIs in pursuit of long-term value. Companies must beware of the formation of silos and internal misalignment on wider company goals between departments, which lead to tunnel vision, push-back and low quality implementation. A common example is the conflict of interest between sales and cost centres, leading to either topline targets or cost savings achieved at the detriment of the other. This can be addressed through a clear prioritisation process, facilitated conversations across key functions and dedicated resources to achieving compromise. Taking the middle ground will not be the indicator of successful alignment – a compromise in lieu of company objectives will.

Evaluating the financial performance of an SKU leverages heavily on allocating key components in the cost-to-serve equation to individual SKUs to obtain gross and contribution margins. Analysis quality is only as good as the quality of its input data – underlying assumptions such as allocation base have significant implications on the results of the rationalisation and if suboptimal, may result in the trimming of well-performing SKUs mistakenly classified as poor performers along select KPIs. Companies can mitigate this through comprehensive analysis of cost drivers and testing existing assumptions through iterations of rationalisation execution and review.

The gap between actionable insights and executing on said insights is a major factor in determining the long-term benefits reaped from a rationalisation exercise, especially in the context of operations and workflows. Compared to insight derivation, this step involves more stakeholders and key process owners, requires more nuance in implementation and is far less straightforward. Companies must devote sufficient resources to support the transition following a rationalisation throughout the organisation, be it in terms of product portfolio, brand equity, sales strategy or people-related factors such as upskilling, managing workflow changes and resource allocation, etc. More often than not, such responsibilities fall to the decision makers in the rationalisation exercise – companies should recognise shared responsibilities and understand that a new pair of hands, more experienced or suited in implementing solutions, may be required to take over from the initial decision makers. A possible solution is the concept of segmenting and allocating scopes to different process owners, to make good executive decisions on what to rationalise and address the issue of how and when.

SKU rationalisation has always been a continuous process, enabled now more than ever with the advent of analytical capabilities and round-the-clock data collection. A key component of the value in rationalisation lies in the future insights derived from acting on current actionable items and with each performance, product portfolios and existing frameworks are refined to maximise value. Opportunistic rationalisation exercises conducted in times of distress fail to leverage on this, resulting in superficial performance analysis and one-off improvements with minimal impact. Successful companies integrate rationalisation into workflows and continually improve analysis processes, implementation frameworks and strategies, developing self-sustaining engines over time.

IGPI has deep experience in strategising, developing, analysing and implementing sustainable product optimisation solutions for companies across all parts of the value chain based on a proprietary approach, leveraging our expertise in multiple sectors in the wider CPG industry. To find out more about how we can support your value creation endeavours, get in touch with us here.

Mr. Hoong Tian Jin is an Associate in IGPI Singapore. Before joining IGPI, Tian Jin started his career at Ernst and Young Singapore in the Assurance service line, where he led digital audits and reviewed operational controls of healthcare, pharmaceutical and manufacturing companies. During his time in university, he also worked at an e-commerce start-up performing business development, online marketing and search-engine optimisation. He graduated from the National University of Singapore with a Bachelor of Business Administration (Accountancy). Tian Jin is proficient in English and Mandarin. He is passionate about corporate and social responsibility and volunteers regularly with numerous non-profit organisations to give back to society. In his leisure time, he enjoys football, music and chess.

Industrial Growth Platform Inc. (IGPI) is one of Japan’s premium management consulting and investment firms headquartered in Tokyo with offices in Singapore, Hanoi, Shanghai and Melbourne. IGPI was established in 2007 by former members of Industrial Revitalization Corporation of Japan (IRCJ), a USD 100 billion sovereign wealth fund focusing on turn-around projects in Japan. IGPI has 14 institutional investors, including Nomura Holdings, SMBC, KDDI, Recruit and Sumitomo Corporation to name a few. IGPI has vast experience of supporting Fortune 500s, Govt. agencies, universities, SMEs and funded startups across Asia and beyond for their strategic business needs such as market entry and growth strategies, various aspects of M&A, innovation advisory, new business creation etc. IGPI is consciously an industry agnostic firm (work in 10+ industries) and this coupled with it making our own venture investments (30+ till date) adds to our uniqueness. One of our recent investment endeavours has been a VC fund in Europe (EUR 100mn fund) along with Honda, Panasonic, JBIC etc. (a couple of our investees are now unicorns). IGPI group has ~6,000 employees on a consolidated basis.

* This material is intended merely for reference purposes based on our experience and is not intended to be comprehensive and does not constitute as advice. Information contained in this material has been obtained from sources believed to be reliable, but IGPI does not represent or warrant the quality, completeness and accuracy of such information. All rights reserved by IGPI.